Superannuation

Our Approach

Superannuation funds are significant and sophisticated financial institutions. They are entitled to legal advice which is best-of-breed and tailored to the unique requirements of the superannuation industry. This is what we offer at Gilbert + Tobin.

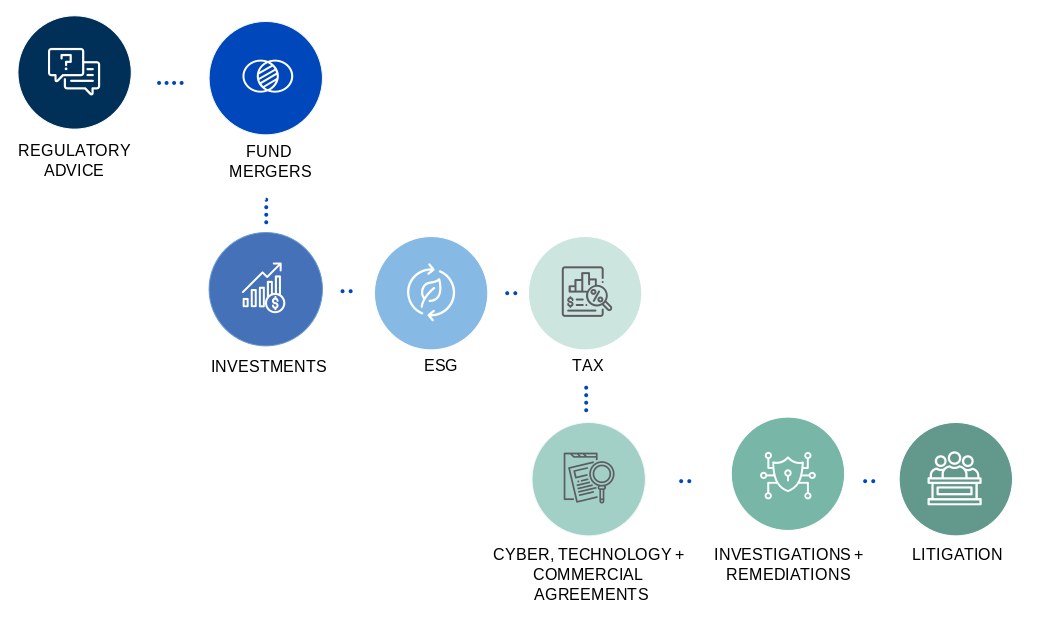

Gilbert + Tobin’s superannuation team advises on the full spectrum of legal issues that arise for superannuation funds and other participants in the superannuation sector.

Our experience spans advisory work on superannuation law through to fund mergers, investments, tax, technology vendor agreements, cyber issues, breach reporting and remediation, regulatory investigations and litigation.

Our advice is underpinned by our genuinely deep understanding of the superannuation industry. Our lawyers have lived experience navigating the operational and commercial realities within superannuation funds, competitive pressures, internal governance structures and relationships with regulators – including time working within industry.

Our superannuation clients access specialised advice from leading practitioners in every relevant domain, ensuring tailored guidance without overlooking industry-specific issues.

This is critically important when advising on investment transactions, technology agreements and other commercial agreements for the superannuation sector, because of the unique requirements of superannuation funds.

Gilbert + Tobin is deeply committed to this sector, continuously expanding its teams and offerings in response.

We are here to alleviate the pressures on inhouse legal teams, providing genuine peace of mind to inhouse lawyers, fund executives and trustee boards. Our advice is solutions-focused, pragmatic, and plainly expressed.

Our Experience

- [G+T matter] IOOF on the $975 million acquisition of ANZ’s One Path Pensions and Investments and aligned dealer groups businesses and related capital raising and on the acquisition of Wealth Central as part of IOOF's "Advice 2.0 transformation strategy".

- [G+T matter] KKR on the proposed acquisition of a 55% interest in Colonial First State (CFS) and establishment of a joint venture with Commonwealth Bank of Australia.

- [G+T matter] Aon in relation to Australian aspects of the US$30 billion merger with Willis, Towers Watson.

- [G+T matter] Aware Super, Macquarie Infrastructure and Real Assets and its managed funds (“MIRA”) on the consortium’s $3.5 billion acquisition of Vocus Group Limited by scheme of arrangement.

- [G+T matter] PowAR consortium (QIC, Future Fund, AGL) on its $3 billion acquisition of Tilt Renewables by scheme of arrangement.

- [G+T matter] BGH consortium (including BGH Capital, AustralianSuper and Rod Jones) on the $2.1 billion acquisition of Navitas by scheme of arrangement, the largest take private by an Australian PE fund.

- [G+T matter] IFM Investors on numerous acquisitions/investments including Zuuse; My Plan Manager; Collette; ISGM; and Endeavour Learning Group.

- Acted for Qantas Superannuation on numerous matters including investments, regulatory matters and restructures.

- NGS Super regarding various investments in Australia and overseas.*

- A superannuation provider in relation to an ASIC investigation into their superannuation products.

- BT Financial Management and Westpac Life Insurance Services in relation to a class action concerning their superannuation cash product.

- Amcor Limited in relation to various issues relating to its self-managed superannuation fund with a value in excess of $1.5 billion.

- Major outsourcing, custodial and administrating arrangements for numerous super funds, fund managers and institutional investors including Hub24, Qantas Super, Rest, Perpetual and First State Super (now Aware Super).

- Investment management arrangements in relation to co-investment and fund investment work for HESTA, Aware Super, Sunsuper, AustralianSuper, Testra Super, Commonwealth Superannuation Corporation, Statewide Super, Rest Super and HostPlus.

- Aware Super on its build to rent developments throughout Australia.

- REST Super on its $500 million investment management arrangement with QIC.

- MTAA Super (now Spirit Super) in relation to its investment in the South Australian Life Sciences Partnership, including the restructure of that partnership.

- Aware Super on the implementation of its wealth platform with DST BlueDoor.