This is a service specifically targeted at the needs of busy non-executive Directors. We aim to give you a “heads up” on the things that matter for NEDs in the week ahead – all in two minutes or less.

In this edition, we consider recent guidance from ASIC on the issue of “greenwashing” in relation to financial products. We also consider the Takeovers Panel’s decision to decline to conduct proceedings in relation to Nex Metals and the WA Court of Appeal’s decision to dismiss an appeal by Recce Pharmaceuticals in relation to the conversion of performance shares.

In Risk Radar, we consider the recent losses sustained by the ASX amid fears of a global recession.

GOVERNANCE & REGULATION

ASIC releases “greenwashing” information sheet.

Last week, ASIC released a new information sheet identifying steps to be taken by superannuation and managed funds to mitigate “greenwashing” risks. While directed at financial issuers, Information Sheet 271 is also relevant to investors and companies listed on the ASX. After undertaking a review of a sample of superannuation and investment products, ASIC has identified areas for improvement and provided some key questions to be considered to avoid engaging in greenwashing. ASIC has flagged that promotion of financial products and related disclosure should at the very least use clear labels, define the sustainability terminology used and clearly explain how sustainability considerations are factored into their investment strategy. ASIC has also formulated nine key questions that should be considered to determine whether disclosure provides investors with consistent, clear and concise information about the sustainability of the product being promoted or offered, and to avoid misleading or greenwashing behaviour. The information sheet does not provide any new regulations – but provides updated guidance on how to comply with the existing regulatory framework under the Corporations Act 2001, ASIC Act 2001 and Corporations Regulations 2001. See ASIC’s media release. As noted in previous editions of Boardroom Brief, this is one area of regulatory oversight which we expect to be very active in coming months.

LEGAL

Takeovers Panel declines to conduct proceedings in relation to Nex Metals.

In a previous edition of Boardroom Brief, we considered an application by Nex Metals Explorations Ltd (Nex Metals) in relation to its affairs. To recap, Nex Metals is the subject of an off-market scrip takeover bid from Metalicity Ltd (Metalicity). The Panel has found itself in the unusual position of effectively “micro managing” aspects of Nex Metals’ defence, which was seen as deficient in several respects. On this occasion, however, it was Nex Metals that had raised concerns about Metalicity’s ongoing disclosure in respect of the takeover bid, in particular relating to the decline in the Metalicity share price since the bid was launched. The Panel admits to having concerns in respect of Metalicity’s disclosure, however, was satisfied that its concerns had been sufficiently addressed by lodgement of a supplementary bidder’s statement. The Panel therefore concluded that there was no reasonable prospect it would make a declaration of unacceptable circumstances and declined to conduct proceedings. Reasons for the decision will be published in due course. See the Panel’s media release.

WA Court of Appeal upholds decision obliging conversion of performance shares for former employees.

In 2015, Recce Pharmaceuticals Ltd (Recce) issued performance shares to specific directors and key management personnel. After the conversion of the two classes of performance shares in 2016, some of the holders ceased to hold their respective roles at Recce. In 2017, Recce achieved the milestones relevant to the remaining two classes of shares and released an announcement asserting that there was an implied term that they would only be eligible for conversion if the holder continued to hold office when the relevant milestone was achieved and materially contributed to achieving the milestone. The former directors and key managers sought orders in the WA Supreme Court requiring the conversion of the performance shares and rejecting that implied term. The WA Supreme Court ruled in their favour. Recce brought an appeal in the WA Court of Appeal which upheld the original decision and dismissed the appeal. The Court of Appeal in Recce Pharmaceuticals Ltd v Brown [2022] WASCA 66 held that ordinary principles of construction should apply to the terms of issue of the performance shares and that the term ‘performance’ did not refer to the individual’s performance, but performance of the company. There was also nothing on the face of the clause to suggest that the holders needed to remain in office, and therefore such a term should not be implied. The decision highlights the importance of thorough forward-thinking when issuing performance-based incentives, and ensuring the terms of those incentives accurately reflect the intentions of the company, especially around the impact of ‘good leavers’ or ‘bad leavers’.

RISK RADAR

ASX200 experiences worst week since local onset of COVID-19.

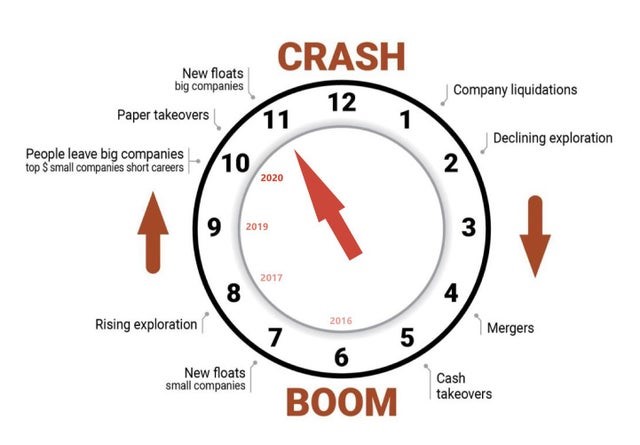

The ASX experienced a week of losses following the open of trading after the public holiday on Tuesday 14 June. The S&P/ASX200 closed 1.9% down for the week, hitting a 19-month low. Local stocks saw their lowest close since November 2020 and the worst week since March 2020, when COVID-19 really hit locally. Investor sentiment is low given rising interest rates and inflation and ongoing fears of a global recession. While the market has definitively entered bear territory with the “beginning of the end” of loose monetary policy globally, we expect some well-funded acquirers will cherish the opportunity to acquire assets at more reasonable valuations, particularly in the resources sector where high commodity prices are propping up the earnings of operating businesses (albeit this will be challenged in a recessionary environment. On the classic “Market Clock” (below), we are perhaps “closer to midnight”).

Visit SmartCounsel