The latest developments on the merger reforms

The ACCC has published draft merger process guidelines for consultation, outlining the processes applying to the new merger regime.

Submissions are due on 28 April 2025.

Transition provisions apply from 1 July 2025, when the new regime commences on a voluntary basis before becoming compulsory on 1 January 2026. The ACCC may refine the process following this transition period, before finalising the guidelines.

The draft guidelines supplement the ACCC’s guidance on transitional arrangements and draft merger assessment guidelines (also out for consultation), as we explain here and here as part of our ongoing coverage of the new merger regime.

On 28 March 2025, Treasury published the much-anticipated draft determination setting out the proposed notification thresholds and forms for the new merger regime. We will provide a client update later this week on thresholds and forms.

What have we learnt?

The draft process guidelines largely restate the legislation (and explanatory material) and offer only limited new insights into the new regime. The ACCC has also flagged that it is yet to release a range of other guidance on important parts of the regime, including how they will approach remedies and how the register will work.

So, what have we learnt?

Pre-notification processes will become very important and parties will need to be organised early and build in time to engage before filing: The ACCC expects parties to pre-engage, at least 2 weeks prior to filing and “much earlier” for complex acquisitions, for example acquisitions that involve concentrated markets or are part of a global transaction subject to assessment by other agencies. The ACCC expects to discuss any remedy proposals at this very early stage (for example a court enforceable undertaking) and see a “best offer” by early in Phase 1, warning it is “very unlikely that there will be time for the ACCC and the Parties to engage in an extended, iterative process”, as seen with remedies proposed in recent applications under the informal clearance regime.

Pre-filing engagement will also be important if aligning timing around global deals: The ACCC is concerned to ensure that its processes align with other regulators for global deals. This can be managed through pre-filing engagement. The ACCC will also look for confidentiality waivers to allow it to liaise with other global regulators.

The cost and up-front information required is significantly greater and may be difficult for small firms, in some markets and on smaller deals: Draft regulations have been released by Treasury that include both a ‘short form’ and ‘long form’ draft application. Even the short form application reflects a step up from the current practice (which is flexible and permits merger parties to provide the information which they think is substantively needed by the ACCC to assess a merger). Moving forward, on all deals, parties need to be prepared to provide detailed data around market shares, turnovers, prior deals (over the last 3 years), top customers and competitors, transaction and financial documents, details of any non-compete agreed to protect the goodwill being acquired, organisational charts, Board papers and other material. The long form application for complex deals is more involved, with detailed data and information around barriers to entry, theories of harm and more. There are also a range of new fees that will apply, at each stage of the process (Phase 1, Phase 2, Substantial Public Benefits and any Tribunal review).

The ACCC can hold off on starting each phase of the process until it is satisfied that all necessary information has been provided, and fees paid.

However, for matters that do not raise competition risks, the extent of upfront information required and cost could be avoided through the waiver process: The ACCC has said it is prepared to waive the requirement to notify transactions that would otherwise meet the thresholds but do not raise any real concerns. However, the process for seeking a waiver will be public and the ACCC will take at least 10 business days to make its determination so that third parties can make submissions. More guidance on waivers will follow.

Confidentiality is gone: The ACCC will publish details about a notification on the new mergers register within one business day and publicly consult during each step of its review process. There are only two very limited exceptions for certain surprise hostile takeovers or voluntary transfers of authorised deposit-taking institutions and other regulated entities. Even then, the delay in publication is limited. Importantly, the ACCC will not publish the application form or details of submissions.

Timing for complex deals that require the full process will be long – at least 12-18 months (and potentially longer): The process guidelines further reinforce the view that the full ‘end to end’ timeframe for complex deals will be a long one. The process is sequential, with pre-filing engagement, Phase 1, Phase 2, a possible public benefits assessment followed by Tribunal review. Even without clock stoppers or extensions (of which there are many), the minimum timeframes take over 12 months with all phases. But this includes some very tight timeframes that will almost always require an extension, as well as extensions that can be expected for responding to compulsory notices. The most likely timing for a complex deal is 18 months or more.

The process for offering remedies is stricter: If not offered with the initial notification, parties may only offer remedies during specific windows during each phase, that is by the 20th business day of Phase 1; between the 50th and 60th business days of Phase 2; and between the application date and 35th business day of the Public Benefits Phase. When a remedy is offered within these windows, the ACCC may extend the timeline by up to 15 business days. It is possible for the parties to request clock stops to extend these windows. The ACCC will provide updated guidance on its approach to remedies.

Non-compete exemption to protect goodwill can be declared invalid in particular cases: Where parties to a deal are looking to include a business restraint to protect goodwill, which may be exempt from the cartel prohibition under current laws, the ACCC can declare the exemption unavailable and has indicated it will want to see documents and submissions that justify the restraint. This is a major change from the current law, which provides an exemption from being considered per se unlawful if necessary for the sole purpose of protecting the goodwill acquired by the purchaser. The ACCC would need to go to Court to challenge the exemption under current law.

Even after clearance, you need to wait 14 days: Even once the ACCC makes a decision to clear a deal, the parties must wait 14 days to complete, in case a third party brings an application to challenge the deal in the Tribunal. It remains to be seen whether this right to drag out transactions in the Tribunal is used as a spoiling tactic by third parties.

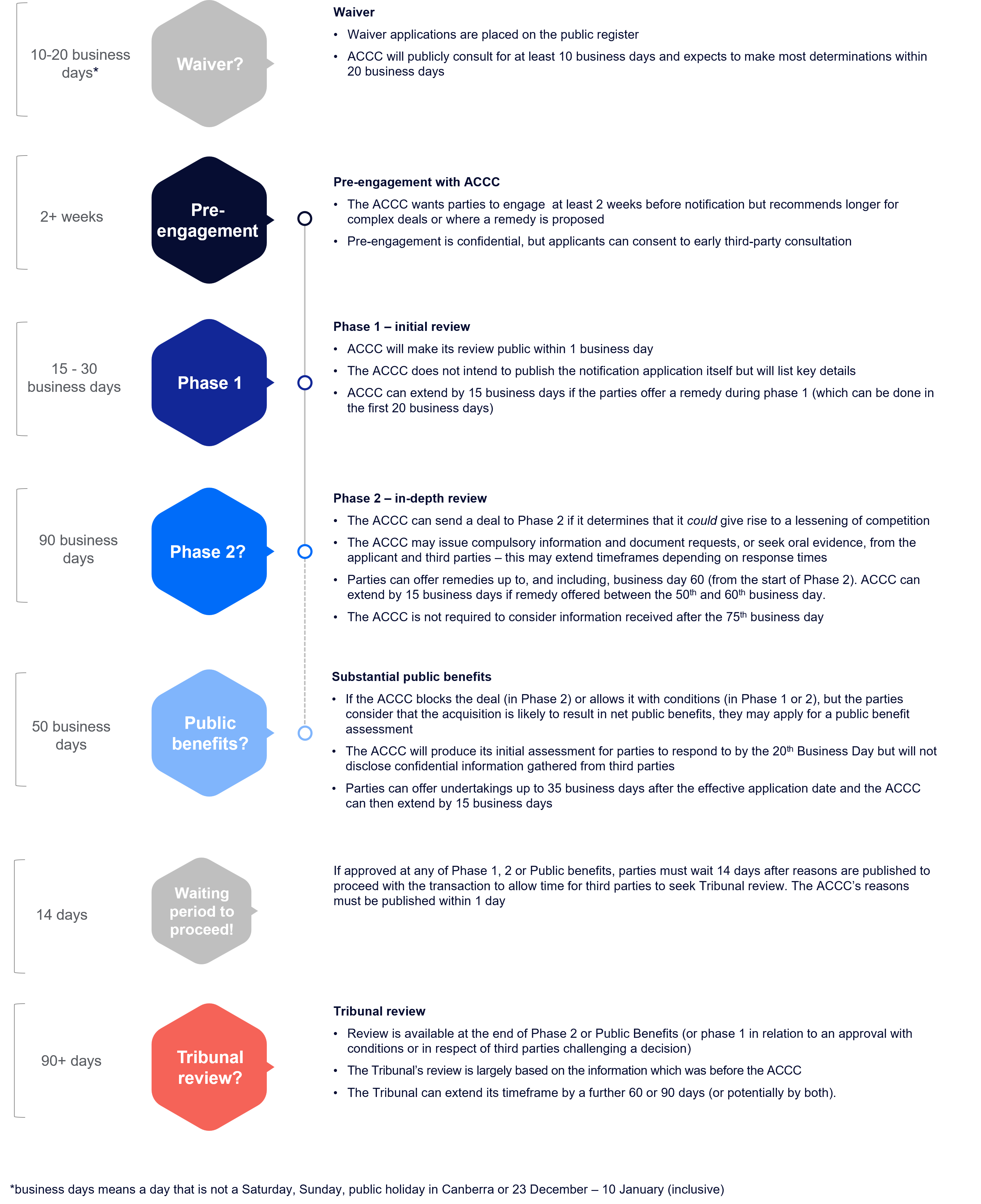

The graph below summarises some key parts of the ACCC’s new merger review process under the new regime.