On 19 June 2024, the Australian Prudential Regulation Authority (APRA) launched a Beta version of its new digitised Prudential Handbook.

The new Prudential Handbook brings together all APRA policy standards, guidance, and supporting information in one convenient place.

Key takeaways

APRA has released a new Prudential Handbook which brings together all prudential standards and prudential practice guides, as well as associated letters to industry, information papers, and FAQs in a digitised and searchable form.

The new Prudential Handbook is the culmination of APRA’s multi-year programme of modernising the prudential framework.

The Prudential Handbook has currently been published as a ‘Beta’ version. APRA is inviting feedback ahead of the expected release of the final version at the end of July 2024. APRA will continue to enhance the final version of the Prudential Handbook based on user feedback so it remains fit for purpose.

APRA modernising the prudential framework

On 12 September 2022, APRA published an Information Paper on its new strategic initiative to modernise the prudential architecture.

In the Information Paper, APRA noted the financial system and prudential framework appeared to be at an inflection point. APRA stated that while the framework had been effective in supporting safety and stability over the past 20 years, it needed to change and continue to adapt for the next 20 years and beyond.

At the time of launching the strategic initiative, the prudential framework consisted of 140 prudential standards and prudential practice guides covering the five APRA-regulated industries as well as a large volume of supporting advice in the form of industry letters, information papers and FAQs.

APRA acknowledged at the time that navigating this large and complex prudential framework can be complex. This complexity makes it difficult for regulated entities to find and understand requirements, complicating risk management and amplifying compliance costs.

APRA also referenced the Australian Law Reform Commission (ALRC) review of financial services legislation in which the ALRC stated that complexity makes the law difficult to understand, harder for entities to comply with and for regulators to enforce and can lead to increased costs for the system.

Simpler, clearer, and more adaptable

The ultimate goal of the strategic initiative is to make the prudential framework (meaning APRA’s standards and guidance) simpler, clearer, and more adaptable.

APRA has sought to achieve this through a three-part programme:

1. Better regulation

This will involve simplification of the structure and approach to standards and guidance as well as the rationalisation of requirements where appropriate. An example of this initiative in practice is the new APRA Prudential Standard CPS 230 Operational Risk which rationalises five standards into one.

APRA also intends to make requirements clearer and ensure guidance is targeted and outcomes-focused. One way APRA has sought to do this is by producing integrated prudential practice guides that more closely link specific requirements in the standards with associated guidance so that regulated entities can better understand how the two relate.

APRA further considers that helping directors understand their obligations will be a key step in better regulation. APRA expects the obligations of the Board will evolve as the prudential framework simplifies over time. As part of this approach, APRA has published the ADI Guide for Directors which is designed to assist directors of authorised deposit-taking institutions in understanding their obligations.

2. A digital-first approach

A digital-first approach means exploring how technology can be used to make accessing and managing the prudential framework easier. The digital Prudential Handbook is a key piece of this workstream.

Moving forward, APRA has signalled that it will look at how standards can be drafted in a way that supports technological integration - for example, developing machine-readable regulations to facilitate Regtech solutions.

3. New risks, new rules

APRA plans to adopt a disciplined approach to guidance and advice, providing clarity on expectations while maintaining cohesion in the framework, rather than a patchwork of supporting advice.

APRA has clarified the modernisation initiative will not involve changes to materially strengthen or relax existing prudential requirements.

Features of APRA’s Prudential Handbook

APRA’s new digital Prudential Handbook introduces the following key new features:

All APRA prudential standards and prudential practice guides, as well as associated letters to industry, information papers, and FAQs, are now accessible and searchable in digitised form on a single website.

When viewing one Prudential Standard, viewers can access various ‘related documents’ (such as letters to industry, information papers and FAQs) of that Prudential Standard in one list and there are clear links for notifying a breach under that Prudential Standard (should there be a case to do so).

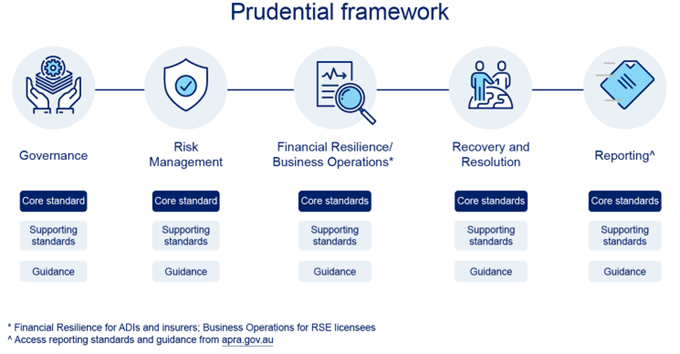

Standards and guidance are organised into pillars and ordered by ‘core’ and ‘supporting’ to give APRA-regulated entities a view of how the Prudential Standards fit in the broader picture of the prudential framework. The pillars are titled governance, risk management, financial resilience/business operations, and recovery and resolution planning which is similar to how the Prudential Standards were previously sectioned.

APRA refers to a ‘core standard’ and ‘supporting standards’. The ‘Risk Management’ pillar, for example, categorises the supporting standards by ‘material risk’ (i.e. operational risk, credit risk and market risk). ‘Liquidity risk’ and ‘capital risk’ have been separated into a new pillar, ‘Financial Resilience’. These risks are often considered as material risks in an entity’s risk management framework. Paragraph 26 of APRA CPS 220 Risk Management states that the risk management framework must, at a minimum, address credit risk, market and investment risk, liquidity risk, insurance risk, operational risk, risks arising from the strategic objectives and business plans, and other risks that, singly or in combination with different risks, may have a material impact on the institution.

Source: APRA website - accessible here .

As a piece of digital architecture, the Prudential Handbook may be searched, filtered and downloaded. For example, users can search ‘attestations’ across all prudential standards and guidance across all five APRA-regulated industries. Content can also be filtered by each APRA-regulated industry. Users can download the Prudential Handbook for integration into obligations registers and other compliance tools and controls.

Best-in-class handbooks

While the new Beta version of the APRA Prudential Handbook is a welcome development, it does not contain some of the enhanced features of the UK Prudential Regulation Authority (PRA) Rulebook or the UK Financial Conduct Authority (FCA) Handbook.

For example, both the PRA Rulebook and FCA Handbook allow users to search historic versions of rules and guidance as well as see upcoming changes. Users can adjust their settings to see applicable rules and guidance at a point in time (past, present, and future).

The PRA Rulebook and FCA Handbook have embedded definitions of key terms so that users may click the hyperlinked terms and be taken to the relevant part of the standardised glossary. Clicking key terms also allows users to a glossary tree which shows how the highlighted term relates to other terms in the glossary. While embedded definitions are included in the APRA Prudential Handbook, the Prudential Handbook does not contain an overarching and standardised glossary nor do definitions show how defined terms are related to other defined terms. Defined terms remain listed in respective standards such as GPS 001 Definitions for general insurance and APS 001 Definitions for authorised deposit-taking institutions. [ND1]

The PRA Rulebook and FCA Handbook allow users to export selected parts of rules and guidance in PDF format and/or print and email selected content.

Next steps

APRA has indicated that its approach will be iterative and evolutionary, involving a series of initiatives over a multi-year period. This will involve new initiatives introduced over time and the review and consolidation of standards as and when they are updated.

The Prudential Handbook is currently in a ‘Beta’ version. APRA is inviting feedback through roundtable sessions to be held in early July and via PrudentialHandbook@apra.gov.au .

The handbook will run in parallel with the existing APRA website (which currently hosts links to standards and guidance) for the next few months to facilitate a smooth transition.

The final version of the handbook is expected to be released at the end of July.