Australia generally welcomes foreign investment. The Australian government screens certain foreign investment proposals on a case-by-case basis (based on who the acquirer is, what is being acquired and how the acquisition is being made) to determine whether a particular proposal is contrary to the national interest or, in certain circumstances, national security only.

This guide explains some of the rules governing the screening process and is for general information purposes only. Australia’s foreign investment rules are complex, and this guide is not exhaustive. This guide does not constitute legal advice. If you want legal advice, you should seek specific advice tailored to your circumstances and you should not rely on this publication as a substitute for obtaining legal advice. This guide is current as at 20 January 2025.

Section 2.0 What laws govern foreign investment?

The main laws that regulate foreign investment in Australia are:

the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FATA) and the Foreign Acquisitions and Takeovers Regulation 2015 (FATR). Together these give the Australian Treasurer the power to review foreign investment proposals that meet certain criteria and to block such proposals that are contrary to the national interest (or national security, as applicable), or apply conditions to the way such proposals are implemented, to ensure they are not contrary to the national interest (or national security, as applicable); and

the Foreign Acquisitions and Takeovers Fees Imposition Act 2015 (Cth) and its associated regulations. These set the fees for the various kinds of applications that may be made.

Separate legislation imposes other requirements in respect of foreign ownership in certain industries. This guide does not cover these industry specific requirements.

Section 3.0 Some key foreign investment concepts

The following are important concepts in the legislation that help to determine whether someone is a foreign person (see section 4) or foreign government investor (see section 5) and whether an action is regulated by FATA (see section 6).

3.1 Interest of a specified percentage

Corporations, trusts and unincorporated limited partnerships An interest of a specified percentage in a corporation, trust or unincorporated limited partnership includes the interests of a person’s associates and is measured slightly differently for each, but in general, it counts:

for corporations and unit trusts, ownership interests and the ownership interests a person or its associates would hold if they exercised rights that they have (such as options);

for unincorporated limited partnerships, rights to distributions of property; and

in all cases, voting power and the voting power a person or its associates would hold if they exercised rights that they have (such as options).

In addition, for certain purposes under FATA, if a person has the power to veto any resolution of the board, central management or general meeting of a corporation, unit trust or unincorporated limited partnership, the person is deemed to have an interest of 20% or more.

In many cases, a person is taken to acquire an interest of a specified percentage if they already hold that percentage, and then increase it.

Businesses

An interest of a specified percentage in a business means the value of the interests in assets of the business held by the person and its associates versus the value of the total assets of the business.

Associates

As noted above, the interests that are counted include the interests of a person’s associates. The associates of a person (first person) include (among other things) the first person’s relatives; any person with whom the first person is acting in concert in relation to an action to which FATA applies; partners in a partnership; any entity of which the first person is a senior officer (and vice versa); and a corporation or trustee of a trust in which the first person holds an interest of 20% or more (and vice versa). These are subject to fairly narrow exceptions.

3.2 Substantial interests, aggregate substantial interests and direct interests

The concept of an interest of a specified percentage then feeds into the definitions of substantial interest, aggregate substantial interest and direct interest, which are used frequently in the legislation.

(a) A person holds a substantial interest if (in relation to a corporation, unit trust or unincorporated limited partnership) the person holds an interest of at least 20%, or if in relation to a trust, the person holds a beneficial interest in at least 20% of the income or property of the trust.

(b) The definition of aggregate substantial interest is similar, but it considers the holding of 2 or more persons, the threshold is 40%, and it does not apply to unincorporated limited partnerships.

(c) A direct interest includes:

(i) an interest of 10% or more in the entity or business;

(ii) an interest of 5% or more in the entity or business if the person who acquires the interest has entered into a legal arrangement relating to the businesses of the person and the entity or business; and

(iii) an interest of any percentage in the entity or business if the person who acquired the interest is in a position to influence or participate in the central management and control of the entity or business or to influence, participate in or determine the policy of the entity or business.

Do not be fooled by the terminology – a person can, by virtue of the application of the tracing rules, acquire a direct interest indirectly.

Remember also that the ‘interest’ includes the interests of associates (see section 3.1).

3.3 Tracing rules

Tracing rules operate up through chains of substantial interests, so that if a person has a substantial interest in a corporation, trust or unincorporated limited partnership (higher party), and the higher party has an interest of any percentage in a corporation, trust or unincorporated limited partnership (lower party), the person is taken to hold so much of the lower party that the higher party holds. This test operates through multiple chains of ownership and applies at each level irrespective of whether there is any practical control.

The legislation turns these tracing rules ‘on’ or ‘off’ for certain purposes, most notably in respect of offshore transactions. See the text box ‘Offshore transactions’ in section 6.

3.4 Land

Australian land includes commercial land, agricultural land, residential land and mining and production tenements. Interests include among other things:

a freehold interest;

a lease or license that is reasonably likely to exceed 5 years;

an interest in an income or profit sharing venture relating to land (which includes royalty arrangements) that is reasonably likely to exceed 5 years; and

an interest in a share or unit of an entity where Australian land makes up more than 50% of the assets of the entity.

Section 4.0 Who is regulated under foreign investment legislation?

The legislation generally regulates foreign investment proposals by a ‘foreign person’. A foreign person means:

an individual not ordinarily resident in Australia;

a corporation in which, or the trustee of a trust where in relation to the trust:

an individual not ordinarily resident in Australia, a foreign corporation or a foreign government holds a substantial interest; or

2 or more persons, each of whom is an individual not ordinarily resident in Australia, a foreign corporation or a foreign government, hold an aggregate substantial interest;

the general partner of a limited partnership where in relation to the limited partnership:

an individual not ordinarily resident in Australia, a foreign corporation or a foreign government holds a substantial interest; or

2 or more persons, each of whom is an individual not ordinarily resident in Australia, a foreign corporation, or a foreign government, hold an interest of 40% or more; and

a foreign government or foreign government investor (see section 5).

Section 5.0 Special rules for foreign government investors

Australia scrutinises a broader range of investments by ‘foreign government investors’ than it does investments by other foreign persons.

A ‘foreign government investor’ (FGI) includes:

a foreign government;

an individual, corporation or corporation sole that is an agency or instrumentality of a foreign country but is not part of the body politic of that foreign country (referred to below as a ‘separate government entity’); and

a corporation, trustee of a trust or general partner of a limited partnership where in relation to the corporation, trust or limited partnership (1) a foreign government, separate government entity or FGI, together with its associates (including other FGIs from the same country), holds a 20% or more interest, or (2) FGIs, separate government entities or FGIs, together with their respective associates (including other FGIs from the same country), hold a 40% or more interest. This definition is recursive so that it includes FGIs captured by prior applications and this paragraph.

The definition of FGI captures not only state-owned enterprises and sovereign wealth funds but also things like public sector pension funds, public universities, the investment funds into which state-owned enterprises, sovereign wealth funds, public sector pension funds and public universities invest and, due to tracing rules, portfolio companies for such investment funds.

While many investment funds will be deemed to be FGIs, an exception has been introduced specifically for them. Where:

the investment fund is a scheme in which investors pool contributions to produce benefits;

no individual member of the scheme is able to influence any individual investment decisions, or the management of any individual investments of the scheme (ie, no direct influence); and

no individual member that is an FGI has any position in respect of the fund other than as a member of the scheme, the 40% test described above can be disregarded.

Funds may still benefit from this exception if investors have some influence over the broad investment strategy or are able to participate in collective decision making in relation to the fund, but are not involved in individual decisions about particular investments. Examples include:

being on the advisory committee; and

being able to influence the broad investment strategy of the fund, eg requiring the fund to divest from a particular sector, or to only make investments that meet ethical investing criteria.

For those funds that are still deemed to be FGI by virtue of the 20% test, a passive FGI exemption certificate can be applied for which has the effect that the fund will be treated as a private foreign person (rather than FGI).

Private Equity

Many private equity funds, and by extension their portfolio companies, will be deemed to be FGIs as a result of the application of these rules.

In making an application, a private equity fund manager should expect to provide detailed information about the ownership and control of the manager, as well as the investors in the various fund vehicles. In relation to investors, they will generally need to provide:

the name, jurisdiction of organisation and percentage interest of each person that holds an interest of more than 5% in the fund;

where FGIs from one country collectively hold more than 5% of the fund, the name, jurisdiction of organisation and percentage interest of each such FGI (regardless of how small the holding); and

the aggregate ownership by FGIs, by country.

Note that FGI status is tested for each vehicle that comprises a fund, with association rules then “tainting” the rest of the fund, so purely structuring decisions can influence whether a fund is deemed to be FGI or not.

Section 6.0 What type of foreign investment transactions are regulated under FATA?

There are four types of action which are regulated under FATA:

Significant actions:

The Treasurer has the power to make orders in relation to these kinds of transactions (including to block them, impose conditions or to order divestments) if he or she considers the transaction to be contrary to the national interest. Significant actions only have to be notified if they are also notifiable actions or notifiable national security actions, but doing so and obtaining a notice of no objection cuts off the Treasurer’s powers including the call-in powers described in section 6.5, but subject to the last resort powers described in section 6.6. Once notified, a significant action cannot proceed until a notice of no objection is obtained.

Notifiable actions

These are a category of transactions which must be notified. Most notifiable actions are also significant actions.

Notifiable national security actions:

The Treasurer has the power to make orders in relation to these kinds of transactions (including to block them, impose conditions or to order divestments) if he or she considers the transaction to be contrary to national security. These actions must be notified and cannot proceed until a notice of no objection is obtained.

Reviewable national security actions

These are transactions with an Australian nexus that are not significant actions, notifiable actions or notifiable national security actions. The Treasurer has the power to make orders in relation to these kind of transactions (including to block them, impose conditions or order divestments) if he or she considers the transaction to be contrary to national security. Like significant actions, reviewable national security actions do not have to be notified, but doing so and obtaining a notice of no objection cuts off the Treasurer’s powers including the call-in powers described in section 6.5, but subject to the last resort powers described in section 6.6. Once notified, a reviewable national security action cannot proceed until a notice of no objection is obtained.

6.1 Key significant / notifiable actions

The table below sets out the key notifiable actions (all of which are also significant actions) for onshore transactions, as well as how the treatment differs (if at all) where the action is offshore (ie, indirect acquisitions).

Significant / notifiable actions for onshore transactions (direct acquisitions) | Applicability to offshore transactions via the tracing rules (indirect acquisitions) | How threshold is measured | Acquirer | Monetary threshold (A$) | |

Acquisition by a foreign person of a substantial interest in an Australian company or unit trust valued above the then current monetary thresholds. | Significant action for private foreign investors. Significant / notifiable action for foreign government investors. | Higher of the value of the gross assets of the target entity and the value implied by the consideration paid for the interest. Consideration may be apportioned in offshore transactions based on EBIT. | Non-foreign government investors from treaty countries. All other non-foreign government investors Foreign government investors. |

$339m ($547m for India for certain non- sensitive services businesses.) See ‘direct interests’ below. | |

Acquisition by a foreign person other than a private investor from Chile, NZ or US of a direct interest in and Australian agribusiness (or an entity that carries on an Australian agribusiness) where the investment (together with all prior investments of the acquirer and its associates in the target) is valued above the then current monetary thresholds. | Not significant/ notifiable action for private foreign investors, but maybe caught by other limits. Significant / notifiable action for foreign government investors. | Consideration paid for the investment plus the value of all other investments in that agribusiness held by the acquirer and its associates. | All non-foreign government investors caught by the agribusiness rules. Foreign government investors. | $73m Effectively, $0 (because caught by other limbs below). | |

Acquisition by a foreign person of an interest in Australian land where the interest is valued above the then current monetary thresholds, subject to certain exceptions for small interests in land entities. | Significant / notifiable action for all foreign investors, where the target includes an Australian land entity valued above the relevant thresholds. | Value of the interest in land. Threshold for agricultural land is based on the cumulative value of all interests in agriculture land. | Varies widely depending on whether the acquirer is a foreign government investor; if not, whether the investor is from a treaty country (and if so, the specific terms of that treaty, as not all treaties have the same provisions in respect of all types of land); and the type of land involved (residential, developed commercial, vacant commercial agricultural or mining tenements). | In general:

| |

Acquisition by a foreign person a direct interest in a company, unit trust or business that wholly or partly carries on an Australian media business, regardles of value. | Significant and notifiable action for all foreign investors. | Not applicable. | Any foreign investor. | $0 | |

Acquisition by a foreign government investor of a direct interest in an Australian company, unit trust or business, regardless of value. | Significant and notifiable action for foreign government investors, subject to limited exceptions. | Not applicable. | Any foreign government investor. | $0 | |

Start of any new business in Australia by a foreign government investor, regardless of value. | Significant and notifiable action for foreign government investors. | Not applicable. | Any foreign government investor. | $0 | |

Acquisition by a foreign government investor of a legal or equitable interest in a tenement (including tenements that would not be classified as land) or an interest of at least 10% in securities in an entity where the value of the tenements exceeds 50% of the total asset value of the entity. | Significant and notifiable action for foreign government investors. | Not applicable. | Any foreign government investor. | $0 |

6.2 Other significant actions

From a practical perspective, significant actions that are not also notifiable actions include (among others):

asset deals where the business being acquired is valued above the then current monetary threshold; and

offshore acquisitions by private foreign investors (not involving land entities or media business), where the value of the Australian business is in excess of relevant monetary thresholds.

In general, the thresholds are the same as in the first row of the table in section 6.1.

6.3 Notifiable national security actions

A notifiable national security action includes any of the following actions by a foreign person:

to start a national security business;

to acquire a direct interest (as defined in section 3.2) in a national security business;

to acquire a direct interest in an entity that carries on a national security business;

to acquire an interest in Australian land that, at the time of acquisition, is national security land; and

to acquire a legal or equitable interest in an exploration tenement in respect of Australian land that, at the time of acquisition, is national security land.

Note that there are no monetary thresholds, and the tracing rules can operate to capture offshore transactions. Further, offshore entities can carry on a national security business.

A national security business is one which is carried on wholly or partly in Australia (whether or not for profit) which is publicly known, or could be known upon making reasonable enquiries, to be one or more of the following:

it is a responsible entity or direct interest holder of a critical infrastructure asset within the meaning of the Security of Critical Infrastructure Act 2018 (SOCI Act);

it is a carrier or nominated carriage service provider to which the Telecommunications Act 1997 applies;

it develops, manufactures or supplies critical goods or critical technology that are, or are intended to be, for a military use, or an intelligence use, by defence and intelligence personnel, the defence force of another country, or a foreign intelligence agency;

it provides, or intends to provide, critical services to defence and intelligence personnel, the defence force of another country, or a foreign intelligence agency;

it stores or has access to information that has a security classification;

it stores or maintains personal information of defence and intelligence personnel collected by the Australian Defence Force, the Defence Department or an agency in the national intelligence community which, if accessed, could compromise Australia’s national security;

it collects, as part of an arrangement with the Australian Defence Force, the Defence Department or an agency in the national intelligence community, personal information on defence and intelligence personnel which, if disclosed, could compromise Australia’s national security; or

it stores, maintains or has access to personal information on defence and intelligence personnel which, if disclosed, could compromise Australia’s national security.

National security land is:

certain defence premises;

land in which the Commonwealth, as represented by an agency in the national intelligence community, has an interest that is publicly known or could be known upon the making of reasonable enquiries.

National security business and the SOCI Act

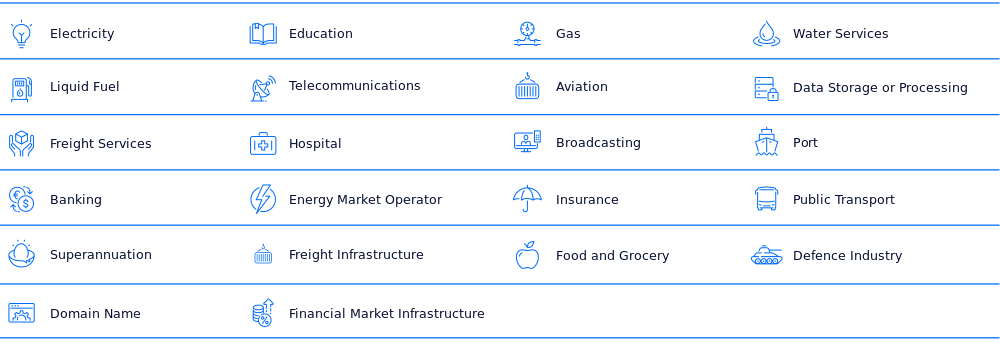

As noted above, one kind of national security business is the acquisition of a direct interest in a responsible entity or direct interest holder for a ‘critical infrastructure asset’, as defined in the SOCI Act. Critical infrastructure assets cover specified assets across 22 different sectors and include those assets which, if disrupted or compromised, could hamper the security or economic well-being of Australia.

Could be known after reasonable enquiry

The definition of national security business includes businesses that are publicly known, or could be known after reasonable enquiry, to be of the specified kind. The government’s expectations as to the level of enquiry that potential acquirers will make are very high.

As an example, in determining whether an asset like a data centre stores or has access to classified information, an acquirer will be expected to obtain advice on Australia’s Protective Security Policy Framework and follow the trails of breadcrumbs in it to determine whether the data centre stores classified information (the target’s views are not dispositive).

Carry on business in Australia

To be caught, an entity must carry on business in Australia. Importantly, this means offshore entities may carry on a national security business.

6.4 Reviewable national security actions

The definition of reviewable national security action is broad and complex, but the actions that will be most frequently caught are an acquisition of shares in a corporation that carries on an Australian business (or a holding entity of such a corporation), or units in an Australian unit trust (or a holding entity of such a unit trust), or an acquisition of assets in an Australian business, in each case which has the result that a foreign person:

acquires, or will acquire, a direct interest in the entity or business; or

will be in a position (or more of a position) to influence or participate in the central management and control of the entity or business; or

will be in a position (or more of a position) to influence, participate in or determine the policy of the entity or business, where the action is not otherwise a significant action, a notifiable action or a notifiable national security action. Importantly, this kind of action can (through operation of the tracing rules) capture foreign corporations if they carry on business in Australia.

Other reviewable national security actions include entering into an agreement relating to the affairs of an entity, or altering a constituent document of an entity, as a result of which one or more senior officers of the entity will be under an obligation to act in accordance with the directions, instructions or wishes of a foreign person who holds a direct interest in the entity where the action is not otherwise a significant action, notifiable action or notifiable national security action. In these cases, the entity in question must generally be an Australian entity.

6.5 Call in powers

In respect of any reviewable national security action, or any significant action that is not a notifiable action or notifiable national security action and for which approval was not sought, the Treasurer retains the power for 10 years after the action is taken to “call in” the transaction for review if she or he considers that the transaction poses national security concerns. Notifying the transaction and obtaining a notice of no objection cuts off this power (subject to the last resort powers described in section 6.6).

Because of the breadth of transactions caught by this, the government has identified a number of categories of businesses in respect of which it encourages investors to seek advance approval (assuming the transaction is not otherwise a notifiable action or notifiable national security action). These include businesses in the following sectors (noting that many businesses previously recommended are now national security businesses (and therefore acquisitions of them will be notifiable national security actions) as a result of the December 2021 changes to the SOCI Act):

banking and financial services;

communications;

commercial construction contractors;

commercial real estate;

critical minerals;

critical service providers and suppliers;

critical technologies;

defence providers;

energy;

health;

education;

information technology, data and the cloud;

nuclear;

space;

gas;

electricity; and

ports.

6.6 Last resort review powers

The Treasurer can re-review actions notified after 1 January 2021 where approval has been given to determine whether a national security risk relating to the action exists, and if certain conditions are satisfied, the Treasurer may impose conditions, or vary or revoke any conditions that have been imposed, and may make orders prohibiting an action or requiring the undoing of a part or whole of an action. This includes, as a last resort, requiring divestment.

The conditions that need to be met before the Treasurer may exercise the last resort power are:

Since the transaction was notified:

the Treasurer has become aware that the applicant made a statement that was false or misleading in a material particular, or that omitted a matter or thing without which the statement was misleading in a material particular;

the business, structure or organisation of the person has or the person’s activities have materially changed; or

the circumstances in which the action was or is proposed to be taken have materially changed.

The Treasurer conducts a review, receives and considers advice in relation to the action from an agency in the national intelligence community, takes reasonable steps to negotiate in good faith with the foreign person, and is satisfied that exercising those powers is reasonably necessary for purposes relating to eliminating or reducing the national security risk and that the use of other options under the existing regulatory systems of the Commonwealth, states and territories would not adequately reduce the national security risk.

The Treasurer is reasonably satisfied that:

the false or misleading statement or omission directly relates to the national security risk;

the national security risk posed by the change of the business, structure or organisation of the foreign person or the change to the person’s activities could not have been reasonably foreseen or could have been reasonably foreseen but was only a remote possibility at the time of the original approval; or

the relevant material change alters the nature of the national security risk posed at the time of the original approval.

Offshore transations

As noted above, the tracing rules can operate to capture offshore transactions. In summary:

offshore transactions which, via the tracing rules, meet the requirements set out in section 6.1 will be captured as either significant actions or notifiable actions, as set out in that section – approval is either required or adviseable in certain circumstances, depending on the circumstances;

offshore transactions which, via the tracing rules, meet the requirements set out in section 6.3 will be captured as notifiable national security actions – approval is required; and

offshore transactions which, via the tracing rules, meet the requirements set out in section 6.4 will be captured as reviewable national security actions – approval is advisable in certain circumstances, and advice should be sought.

Section 7.0 National interest and national security tests

7.1 National interest

In determining whether a foreign investment proposal is contrary to the national interest, the Treasurer is able to examine any factors that he or she considers appropriate. Typically, these factors include the impact of the foreign investment proposal on:

national security;

data security;

competition (noting that this is a different test to the test applied by the Australian Competition and Consumer Commission in examining merger clearances);

the economy and the community (such as the investor’s plans to restructure the business in Australia after the acquisition);

other government policies such as tax and the environment; and

particularly where an investment is made by a foreign government investor, the Treasurer will also consider the character of the investor.

Some kinds of foreign investment proposals give rise to more specific concerns, which the Australian government takes into consideration (in addition to those described above) when examining those proposals:

for agricultural investment proposals, the Australian government typically considers the effect of the proposal on the quality and availability of Australia’s agricultural resources, including water; land access and use; agricultural production and productivity; Australia’s capacity to remain a reliable supplier of agricultural production, both to the Australian community and Australia’s trading partners; biodiversity; and employment and prosperity in Australia’s local and regional communities;

for residential real estate investment proposals, the overarching principle is that the proposal should increase Australia’s housing stock (by creating at least one new additional dwelling); and

where a foreign investment proposal involves a foreign government investor, the Australian government considers if the proposed investment is commercial in nature or if the investor may be pursuing broader political or strategic objectives that may be contrary to Australia’s national interest.

7.2 National security

Notifiable national security actions and reviewable national security actions are reviewed against a narrower “national security” test. There is no particular definition of national security, or what may pose a national security risk. FIRB generally considers whether a particular sector might be a target for espionage, sabotage or foreign interference and the magnitude of disruption that such activities could cause.

Section 8.0 Penalties and offences

8.1 Offences

It is an offence punishable by 10 years imprisonment or a monetary penalty1 for a foreign person to:

take a notifiable action or notifiable national security action without having first obtained a no objection notification from the Treasurer; or

take a significant action that the person has notified to the Treasurer but has not yet obtained a no objection notification for.

The same penalty applies if a person breaches a condition contained in a no objection notification or an exemption certificate.

8.2 Civil penalties

The FATA also contains significant civil penalties for certain breaches. The maximum civil penalty for breaches such as failure to give notice to the Treasurer before taking a notifiable action, taking a significant action in certain circumstances without having first obtained a no objection notification, or breaching conditions contained in a no objection notification, is the lesser of:

2,500,000 penalty units ($825 million); or

the greater of the following:

5,000 penalty units ($1.65 million) (or 50,000 penalty units ($16.5 million) if the person is a corporation);

an amount determined by reference to the consideration or market value for the action.

The FATA also contains a 3-tier infringement notice regime for contraventions of FATA which applies as follows:

tier 1 penalties apply if the person self-discloses an alleged contravention of the FATA before the person is notified by the Commonwealth that the conduct is being investigated;

tier 2 applies in all other cases, except (generally) for high-value acquisitions that are captured by tier 3; and

tier 3 for non-compliance in relation to high-value acquisitions (i.e. above $5 million for acquisitions of residential land or above $275 million in other instances).

The penalties that can be issued under the infringement notice regime are set out in the table below.

Tier | Individual Penalty units | Individual $ | Corporation Penalty units | Corporation $ | |

1 | 12 | 3,960 | 60 | 19,800 | |

2 | 60 | 19,800 | 300 | 99,000 | |

3 | 300 | 99,000 | 1,500 | 495,000 |

Section 9.0 What's new for 2025?

The Register of Foreign Ownership of Australian Assets, to which all acquisitions of land and water entitlements, and any acquisition of shares orbusinesses captured by FATA, must be notified post- completion continues to cause major headaches, including registering entities, wedging required information into rigid online forms and dealing with tracing issues. There is no fix in sight for these issues.

The government has recently announced changes to streamline the processing of applications for low risk transactions. Applications are screened based on the who, the what and the how of the transaction, and applications which are low risk across all of these factors can expect reduced processing times. However, most major international transactions will continue to feature complications across at least one of these factors.

Key to this streamlined approach is a new portal which will go live later this year. All applications will have to be made via this portal, and all communications about an application, as well as future compliance matters, will occur via the portal. An application will not be able to be submitted without the required information. We are expecting significant changes to the way we handle applications and a number of pain points relating to information barriers, submission of confidential information and the like. Please keep an eye out for our updates as the "go live" date for the portal approaches.

For more information, please contact: