On 28 November 2024, the Treasury Laws Amendment (Mergers and Acquisitions Reform) Act 2024 was passed through Parliament.

As we reported here, here, and here, Australia’s merger review system will now move to a mandatory and suspensory notification administrative regime, representing a significant departure from the longstanding voluntary informal clearance process with a judicial enforcement model.

What you need to know

The new system formally commences on 1 January 2026. However, parties may voluntarily notify acquisitions to the ACCC under the new system from 1 July 2025, before the mandatory notification requirements and other remaining aspects of the system commence on 1 January 2026. This means that deal strategy should already be taking the options created by the changes into account, particularly for large or complex multi-jurisdictional transactions.

The key aspects of the government’s merger reforms are:

Mandatory notification regime and notification thresholds

The reforms will convert Australia’s merger process from a voluntary to a mandatory and suspensory regime. There will be a prohibition on mergers above a threshold proceeding without ACCC approval. Failure to notify a notifiable transaction will render it legally void and expose the parties to substantial penalties.

At a high level, parties will need to notify acquisitions involving:

A ‘change of control’ of a target that has a material connection to Australia (i.e., carries on a business in Australia, or plans to carry on a business in Australia).

The transaction meets certain monetary thresholds. The government indicated it intends to set them as follows:

Australian turnover of the combined businesses is above A$200 million, and either the business or assets being acquired has Australian turnover of more than A$50 million or global transaction value above A$250 million.

A very large business with Australian turnover of more than A$500 million buying a smaller business or assets with Australian turnover above A$10 million.

To target serial acquisitions, all mergers by businesses with a combined Australian turnover of more than $200 million where the cumulative Australian turnover from acquisitions in the same or similar goods or services over a three-year period is at least $50 million will be captured, or $10 million if a very large business is involved.

For some transactions involving listed targets, there is a safe harbour which assumes there is no acquisition of control if the transaction would only result in the acquirer obtaining a shareholding of 20% or less, or where the acquirer already has over 20% shareholding and the transaction would increase that shareholding.

Waiver

Following calls from businesses and other stakeholders, the legislation introduces a power which allows the ACCC to waive the obligation to notify an acquisition. It is anticipated that the ACCC will provide a process for parties to apply for a notification waiver.

Designation powers

The Treasurer will have power to designate a particular class of acquisitions as requiring notification, regardless of whether thresholds have been met. To date, the Treasurer has indicated an intention to designate transactions by supermarkets and certain private company investments involving an acquisition of a stake of 20% or more.

Decision maker and timeframes

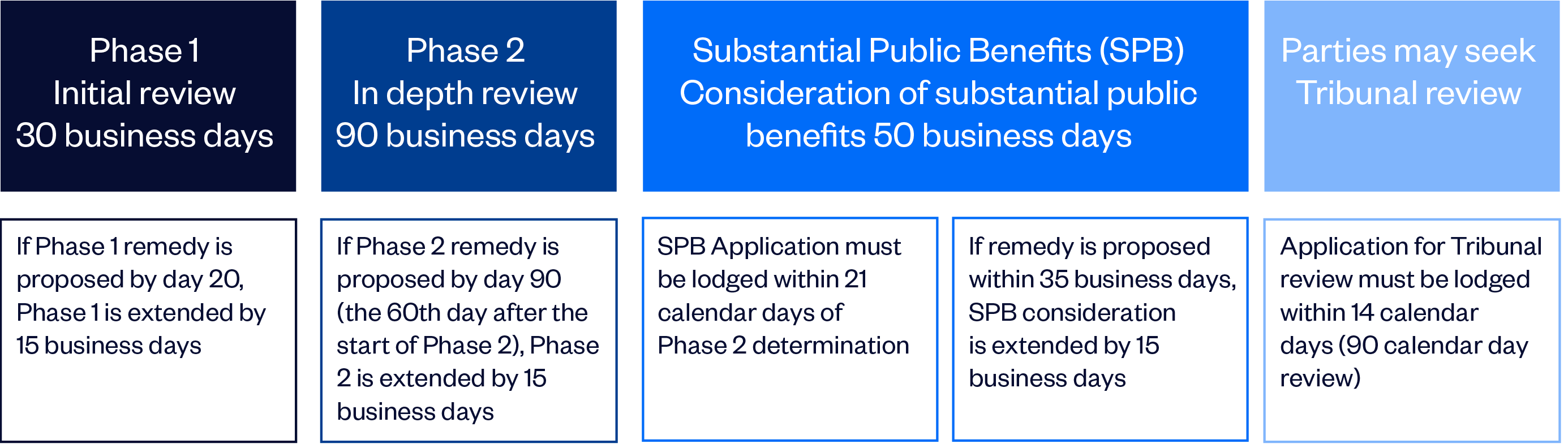

The ACCC will be the first instance, administrative decision maker and the Australian Competition Tribunal will have the ability to undertake a limited merits review of the ACCC’s decisions. The timeframes for the process are set out in the diagram below. The ACCC will have a number of rights to extend these timeframes or 'stop the clock' in specified circumstances. There is scope for the ACCC to waive the requirement to notify and it has already indicated that it wants to use pre-filing engagement more regularly, particularly for complex deals, to help parties identify filing and evidentiary requirements.

Pre-lodgement discussion

The ACCC is keen for merger parties in complex mergers to engage in pre-lodgement discussions with the ACCC, including to identify what data and information should be produced. The statutory timelines will not commence until pre-lodgement discussions have been finalised. More information about the new process will be released through guidelines.

Test to be applied for considering competition impacts and substantial public benefits

A merger will be permitted to proceed unless the ACCC is satisfied that the acquisition would, in all the circumstances, have the effect or likely effect of substantially lessening competition (SLC) in any market. The proposed amendments clarify that a SLC can result from creating, strengthening or entrenching substantial market power. The Explanatory Memorandum emphasises that the amendments are not intended to substantively change the approach to the current competition test, but rather to focus on what mergers may do to market structure. A subsequent process for considering public benefits is available if a deal fails to be cleared based on an SLC analysis.

Focus on serial acquisitions, with a three year look back period

As outlined above, to address concerns raised by the ACCC about serial acquisitions, the government indicated it also intends to set notification thresholds to capture all mergers by businesses with combined Australian turnover of more than $200 million, where the cumulative Australian turnover from acquisitions in the same or substitutable goods or services over a three-year period is at least A$50 million, will be captured, or A$10 million if a very large business is involved.

Further, when assessing the effect of a merger, the ACCC can now also examine the effect of an acquisition as being the combined effect of the current acquisition and any one or more acquisitions over the prior three years.

Clearance as an administrative decision, procedural safeguards and removal of the Federal Court ability to approve mergers

The merger reforms reflect a significant change from the current judicial enforcement model to an administrative model, under which ACCC determinations will be subject to limited merits review by the Australian Competition Tribunal, based primarily on material before the ACCC. Parties will no longer have the ability to challenge the merits of an ACCC decision before the Federal Court. In a welcome development, the legislation responds to longstanding criticism of the current Tribunal review process for merger authorisations by allowing the Tribunal to permit parties to provide new information if it is relevant to the ACCC determination and if the parties were not given a reasonable opportunity to make submissions on that information during the ACCC’s review. There is also scope for new evidence to be introduced before the Tribunal as part of it receiving evidence from experts during any review process.

Residual call-in powers

Unlike mergers that are notified (which have the benefit of an anti-overlap rule preventing them from being prosecuted), acquisitions that do not meet the thresholds may still contravene general prohibitions on conduct or agreements that has or have the purpose, effect or likely effect of SLC. The ACCC won’t have the power to prevent such mergers but can seek orders from the Federal Court (including through an injunction) if they determine the acquisition may contravene the law.

Transitional arrangements

The legislation provides for voluntary notification by merger parties under the new regime from 1 July 2025. There is also statutory protection for any deals that receive informal clearance or merger authorisation before 31 December 2025 provided the transaction is completed within 12 months.

Fees

The Explanatory Memorandum states that filing fees are likely to be between $50,000-$100,000 per transaction, with exemptions for some small businesses.

What’s next

Many important elements of the new regime will need to be developed over coming months, including the regulations for the final thresholds, application forms (which will set out information and documents which must be provided), availability of waivers, filing fees and updated ACCC process and substantive guidance.

Mandatory notification thresholds

Treasury has indicated it will “consult on further detail on the notification thresholds through the development of subordinate legislation (in the form of legislative instruments) later in 2024–25”. At a public hearing on 30 October 2024, Jessica Robinson, Assistant Secretary at Treasury, confirmed that Treasury is in the process of developing the draft instruments for the threshold notification and designation requirements and is well placed to have the instruments ready and out for consultation after the legislation passes. She noted timing of consultation is at the discretion of the Treasurer and government.

New Ministerial power to designate particular sectors

The legislation empowers the Ministerial to impose additional targeted notification thresholds for certain mergers.

Accordingly, the Minister may impose obligations on some sectors, specific deal types and/or particular markets to notify transactions. At this stage, the Minister has indicated an intention to designation mandatory notification for:

all supermarket mergers

interests of 20% or more in private or unlisted companies if one of the parties has turnover of more than A$200 million

the top four sub-industries for serial acquisitions, childcare, aged care, medical GPs and dentists as indicated by the government based on the Competition Taskforce’s merger database project

fuel, liquor and oncology radiology mergers.

ACCC guidelines

The ACCC has also indicated it will publish analytical guidelines and process guidelines in early 2025 to clarify how the ACCC proposes to assess mergers and the process for engaging with the ACCC.

Transitional arrangements

The legislation will allow merger parties to voluntarily notify transactions under the new regime from 1 July 2025. There is some protection for deals that receive ACCC informal clearance or merger authorisation under the current process between 1 July 2025 and 31 December 2025, provided that the transaction is completed within 12 months.

The ACCC will also have waiver powers that exempt parties from notifying certain transactions that are unlikely to raise competition concerns.

What this means for M&A activity in Australia

There are still many important elements of the new regime that will be developed over the coming months. We will keep you updated as these developments occur.

For now, firms considering M&A in the coming 6-12 months may want to start considering the following aspects of transactions:

Timing and process considerations

Parties will need to consider whether to apply to the ACCC for informal clearance under the current regime or wait until the commencement of voluntary notification under the new system, particularly given notified transactions are void from 1 January 2026. There is scope to voluntarily adopt the new notification process from 1 July 2025 and for transactions with complex multi-jurisdictional filings (which may slow or complicate the Australian process), this may be advisable.

Conditions precedent

In light of the above, there will be a need to consider the new regime now when framing conditions precedent.

Jurisdictional nexus

The jurisdictional nexus to Australia is also yet to be properly defined and may mean an increasing number of global transactions involving links to targets with Australian operations will be caught. Under the new regime, in deciding whether a deal has a sufficient Australian nexus, it will be enough for the target to be carrying on, or to have plans to have carry on, a business in Australia. It would also include businesses registered in Australia or which generate revenue in Australia.

Taking stock of recent transactions

Parties may wish to take stock of recent transactions due to the focus on serial acquisitions, with a cumulative three year look back period in terms of both the requirement to notify the ACCC and the competition assessment to be made when assessing the effect of a merger. When assessing the effect of a merger, the ACCC can now also examine the effect of an acquisition as being the combined effect of the current acquisition and any one or more acquisitions over the prior three years.

Sale of business non-competes

Parties will also need to carefully consider any non-compete in the sale and purchase agreement, to the extent it relates to Australia and be mindful of gun-jumping when conducting due diligence and integration planning. Under the current Australian competition law, non-competes in relation to the sale of a business are exempt from the prohibition on cartel conduct if they are solely for the purpose of protecting the goodwill acquired by the purchaser. The ACCC will now have power to declare the exemption does not apply if it is satisfied that the provision is not necessary to protect the purchaser’s goodwill. If the ACCC declares a non-compete to be unlawful, then parties are at risk of any arrangements being declared a breach of the cartel provisions.

Our market-leading Competition, Consumer and Market Regulation team is on hand to answer any questions you have about implementation of the reforms and preparation for mergers and acquisitions in the pipeline.