This week, we review the key findings of Stanford’s 2024 AI Index on the economic impacts of AI in 2024.

Investment in AI research and development

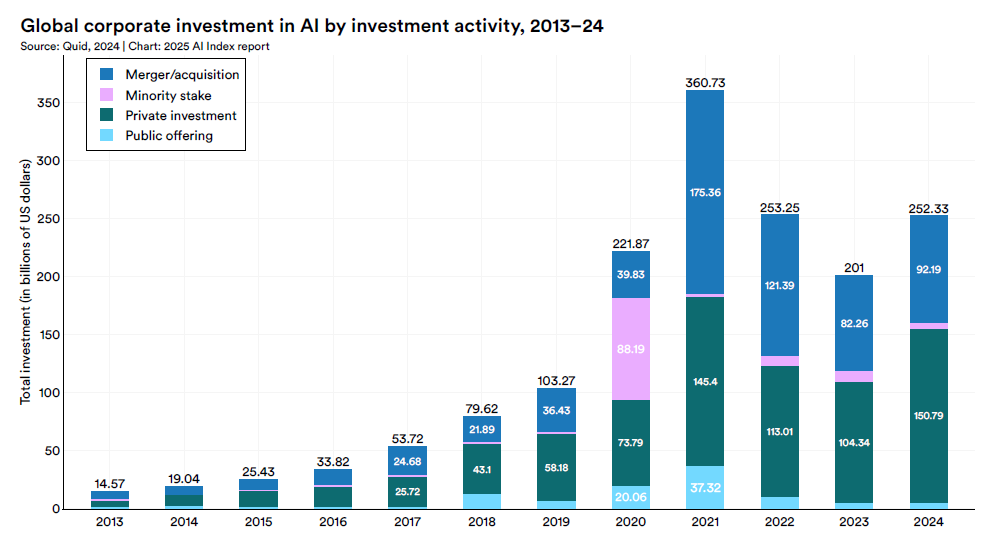

As illustrated below, overall global investment in AI was US$252.3 billion, up by 25.5% from 2023 after several years of steep decline.

At US$33.9 billion, global investment in generative AI represented over 13% of overall AI investment. This might seem surprisingly low given the hype, but investment in generative AI was less than US$5 billion just three years ago.

Private investment is the engine of AI investment, growing by 44.5% while acquisitions increased by 12.1%. The average private equity investment per deal increased significantly from US$31.6 million in 2023 to US$45.4 million in 2024. However, private equity is playing catch up in generative AI – while accounting for 60% of overall AI investment, private equity accounts for around a fifth of investment in generative AI.

As expected, the US leads the world in private investment in AI, reaching US$109.1 billion, 11.7 times greater than the amount invested in the next highest country, China with US$9.3 billion and 24.1 times the amount invested in the United Kingdom with US$4.5 billion.

Since 2013, US private investors have poured over US$400 billion into AI. Over the same period, Australian private investment was US$3.99 billion – behind Canada with US$15.31 billion, Israel with US$14.96 billion and Singapore with US$7.27 billion. US private investment in AI is accelerating much faster than elsewhere in the world: up by nearly 50% since 2023, compared to a 1.9% decline in China over the same period.

US private investors account for 85% of global private investment in generative AI, 14 times that of China and 20 times Europe.

The focus of AI investment shows that we are still in the upstream model building phase. Investment in AI infrastructure, research and governance, driven by the large developers such as OpenAI, Microsoft and Anthropic, was US$37.3 billion in 2024, over 11 times higher than 2013. There also is evidence of an acceleration in downstream sector-specific applications built on the large AI platforms. For example, investment in healthcare AI reached US$14 billion and in fintech AI reached US$7 billion, both tripling investment in 2023. Investment in manufacturing AI was over US$6 billion, over 7 times the level in 2023.

Enterprise use of AI

2024 was the year business finally ‘got AI’, following stagnant levels of uptake between 2017 and 2023.

A global McKinsey survey found that 78% of respondents said their organisations have begun using AI in at least one business function, a big step from 55% in 2023. This higher uptake in AI usage appears to be driven by deployment of generative AI in businesses, which climbed from 33% in 2023 to 71% in 2024. While the US has the highest uptake of AI by business at 82%, uptake is high across all geographies, with Asia Pacific at 72%. Demonstrating the depth of AI’s transformative impact, AI take-up by enterprises in developing economies is a high 77%.

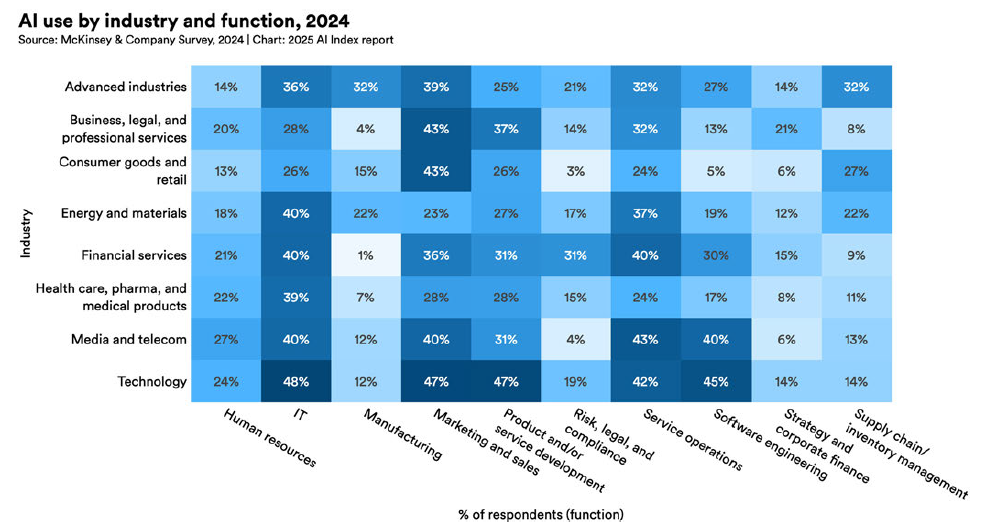

As the following figure shows, the greatest usage of AI was by tech companies across the board, both in their back-office and customer-facing functions.

Across most other sectors, AI was mainly used in back-office functions. Interestingly, professional service firms and retail consumer businesses were among the heaviest users of AI in sales and marketing activities. Professional service firms also used AI more extensively in product development than most other sectors, possibly as professional firms seek to build new products to diversify revenue streams away from billable hours dependent on human labour.

The Index, in something of an understatement, says “[o]verall, most companies are still in the early stages of capturing value at scale from AI”. While enterprises reported both cost reductions and revenue increases where they have started using AI, the results are very modest. For example, 49% of surveyed enterprises reported cost savings from use of AI was in service operations, but nearly 60% of them reported those cost savings were 10% or less. For revenue gains, 71% of enterprises reported revenue gains from use of AI in marketing and sales, but approximately 60% of them reported increased sales revenue of 5% or less.

Enterprise usage of generative AI is unfolding somewhat differently to AI generally. The most common use of generative AI is marketing strategy content support (27%) and the development of “personalised creative content generation at scale” (19%), which might be more cynically characterised as marketing to consumers in their own echo chambers.

Generative AI also delivers greater benefits to enterprises than AI more broadly, although still modest. For example, 44% of the surveyed enterprises using generative AI for knowledge management reported cost savings and close to half of those reported cost savings of 20% or more. Revenue gains from using generative AI were more mixed. For example, 67% of surveyed enterprises reported revenue gains from use of generative AI in supply chains, but just over half reported gains of 5% or less. The rest were roughly evenly split between those reporting revenue gains of 6-10% and of more than 10%.

Labour

Despite dire predictions of AI substituting human employees, the Index found fewer employers predicting workforce reductions in 2024 compared to 2023, “suggesting business leaders are becoming less convinced that AI will reduce organisational workforces”. Nearly 40% of surveyed executives expected AI to have minimal employment impact and among the rest, as many expected AI deployment to result in hiring more employees as those who anticipated shrinking their work forces.

The Index highlighted several findings in 2024 that showed the positive productivity effects of AI usage in business:

The productivity improvements are material but modest: 46.8% of surveyed enterprises reporting gains of 0–20%, 26.2% seeing gains of 20–40%, 18.4% achieving improvements of 40–60% and 8.6% achieving higher gains.

Productivity gains are strongly correlated with an enterprise strategy to deeply integrate AI across the business. One study found that organisations with high AI integration showed a 72% probability of significant productivity improvements, compared to just 3.4% for those with minimal integration. Most enterprises are relatively poor at AI integration: while 36% of occupations use AI for at least a quarter of their associated tasks, only 4% of occupations show AI usage across 75% or more of their tasks, suggesting wholesale automation of entire job categories is not yet occurring.

AI equalises employee performance by boosting performance of less productive, newer and less skilled workers. One study found that junior developers experienced productivity increases of 21–40%, while senior developers saw more modest gains of 7–16%.

AI reshapes jobs. A Microsoft workplace study found that AI automation enabled a 45% reduction in perceived mental demand, closed 84.6% of the accuracy gap for non-primary English speakers and increased the amount of key information being included in professional reports by 49%. A Harvard Business School study found that AI adoption led to reduced collaborative overhead, with projects requiring 79.3% fewer collaborators (team members) on average.

The ability of employees to realise productivity benefits from AI, especially lower-skilled employees, is strongly correlated to their level of AI training and ongoing usage. The Microsoft study found that ‘power users’ (who use AI at least several times a week) reported the strongest productivity gains, with 29% saving 30 minutes or more per working day.

Given all this, the demand for AI-related skills in labour markets is still relatively low. In 2024, AI-related jobs accounted for 1.8% of all US job postings, 3.2% in Singapore, 1.26% in the UK and 1.14% in Australia.

There is high variability across economic sectors for AI skills. For example, in the US nearly 10% of advertised jobs in the information and data sector and just over 5% of jobs in professional services sector require AI skills, dropping away to 1.16% of advertised jobs in retail and 0.82% of jobs in the transport sector.

Using LinkedIn data (which could have a degree of ‘boosterism’ by individuals), the Index calculates the relative level of AI skills concentration in a job category for each country compared to a global average for that job category. In the United States the relative penetration of AI skills was 2.6 times greater than the global average across the same set of job classifications, followed by India at 2.5 times and the UK at 1.4 times. Australia, at 0.95 times, is below the global average of AI skills.

The relative AI skill penetration rate is greater for men than women. The highest reported relative AI skill penetration rates for women were in India (1.9), United States (1.7) and Canada (1.0). In Australia, the AI skills penetration rate is 0.89 for men and 0.68 for women, both substantially below the global average.

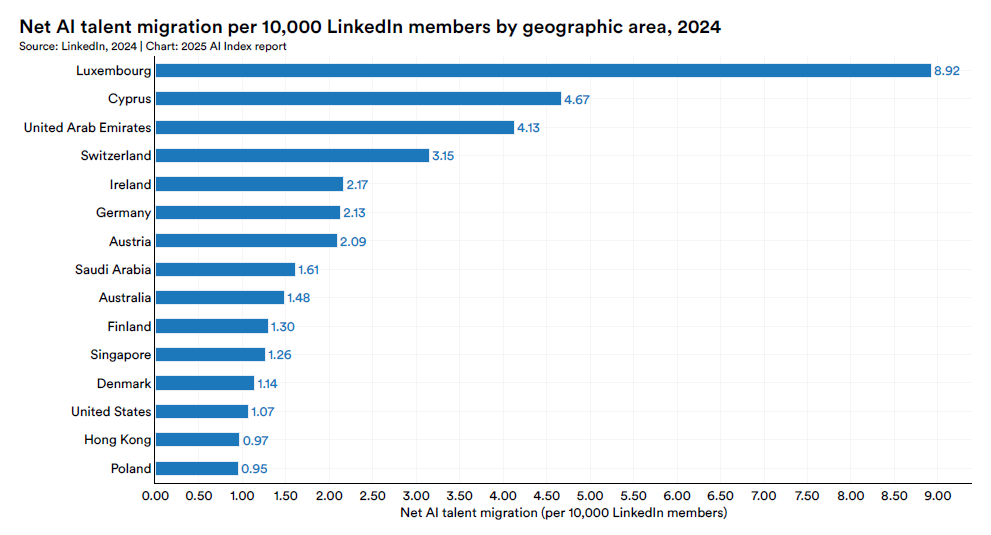

LinkedIn data provides insights on the AI talent gained or lost due to migration trends. As seen in the following figure, Australia ranks above the US and Singapore as a popular destination for AI talent. Given Australia’s low ranks in overall AI talent skills, this suggests that AI-skilled migrants are making a disproportionate contribution to the nation’s AI capabilities.

Conclusion

Generative AI burst into public consciousness with the release of ChatGPT in November 2022 (3 years after COVID!). According to the Index, 2024 is the year we began to see AI shift the tectonic plates of the global economy:

The economic implications of AI came into sharper focus in 2024, with substantive impact across many sectors. Early productivity gains from generative AI are becoming measurable in specific tasks, while questions persist about the technology’s long-term impact on the broader economy. The labor market has begun to show signs of AI driven transformation, with certain knowledge-worker roles experiencing disruption as new AI-adjacent positions emerge. Companies across sectors and geographical regions are moving beyond experimental AI adoption toward systematic integration. Investment patterns reflect a growing sophistication in the AI landscape, with funding increasingly directed toward specialized applications in enterprise automation and industry-specific solutions.

Peter Waters

Consultant