Welcome to our annual Competition and Consumer Insights.

On Thursday 20 February 2025, the ACCC announced its new compliance and enforcement priorities for 2025-26. As we reported here, the priorities largely echo the previous year’s priorities, with a continuing focus on ‘cost-of-living’ consumer protection issues, sharpened areas of focus on competition issues and a new priority to tackle misleading surcharging. While the ACCC’s priorities has implications for businesses economy-wide, the ACCC will continue to focus on competition and consumer protection issues in the supermarket and retail sectors, aviation, essential services, and the digital economy.

In light of these renewed themes and sharpened areas of focus, we offer G+T’s take on the major developments in competition and consumer law and what they mean. 2024 was certainly another hectic year with both familiar themes and some new trends. Here is how we interpret the major trends and data.

Merger clearance trends followed the global zeitgeist with greater scrutiny of complex transactions exploring a broad range of potential theories of harm

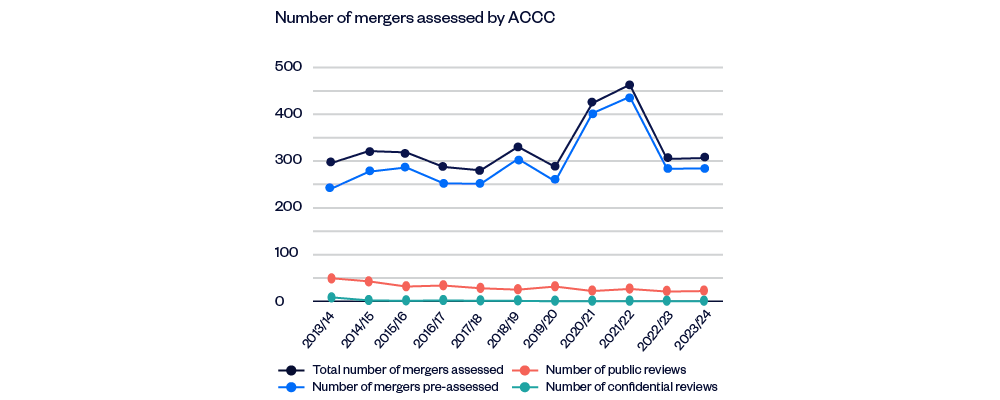

After a couple of busy years post-COVID, the overall number of deals being sent to the ACCC returned to the longer term average in 2024, at about 300 in total. Again, the great majority of these (~93%) were processed through the ACCC’s fast track “pre-assessment" process.

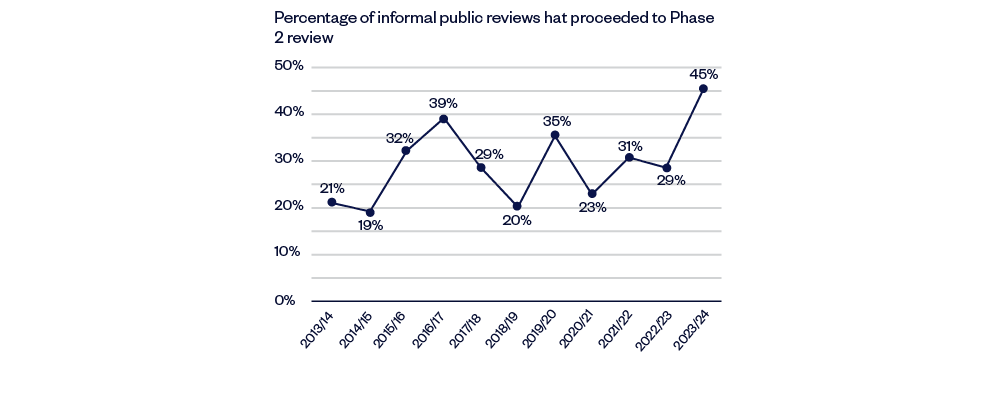

However, consistent with overseas experience, this masks the more challenging environment that complex deals face in Australia, which are taking longer and are subject to greater scrutiny. This was especially the case for deals involving vertical relationships, bolt-ons, those in sensitive industries or with ‘ecosystem’ concerns. For deals that required public inquiries, 2024 delivered the highest proportion of Stage 2 processes in over a decade (45%).

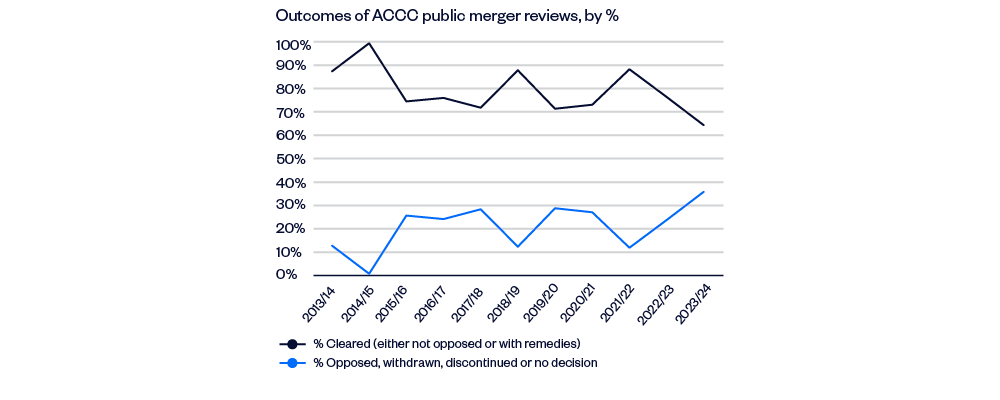

What’s more, if a deal went to Phase 2 in 2024, there was also a higher chance of the transaction not proceeding, with 2024 seeing the highest percentage of public inquiries leading to blocked or withdrawn clearance application in a decade (almost 40%).

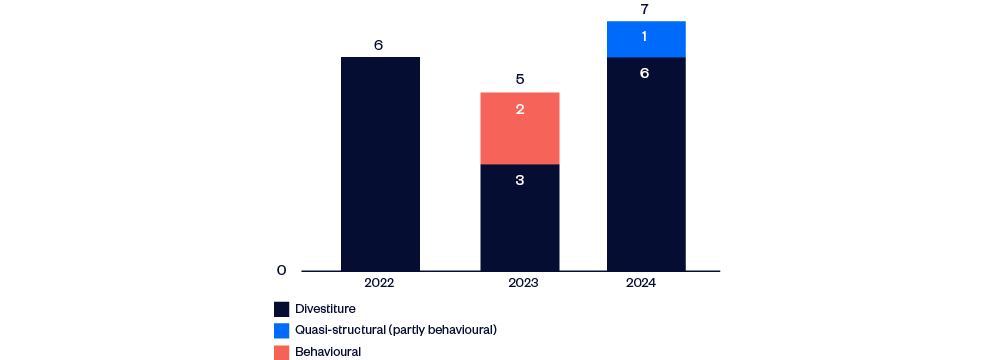

To some extent, this reflected greater toughness by the ACCC around remedies. Where mergers threw up concerns, the ACCC was more likely to prefer a divestiture remedy. Indeed, only one partly behavioural undertaking was accepted during 2024 (in Sigma / Chemist Warehouse).

Major change now looms with mandatory merger filing commencing on 1 January 2026 and the option of voluntarily using the new process from 1 July 2025

Looking ahead, 2025 will be a critical transitional year as Australia moves from its voluntary regime to a mandatory and suspensory notification process. This comes with a range of other changes that together amount to the most substantial overhaul of the merger process since it was introduced 50 years ago.

The new regime was legislated in late 2024 and is mandatory from 1 January 2026. Voluntary filing will be possible form 1 July 2025. This means that merger parties face a critical strategic decision in relation to deals during the year, when both regimes will operate in parallel.

Important detail around how it will work is expected during the first quarter of 2025 (if a Federal election doesn’t create delays).

What is clear is that the reforms and proposed thresholds for filing will significantly expand the number of deals caught and the level of work and cost required for clearing most transactions, including Australian aspects of global deals. The process itself also looks likely to involve a different and new model of engagement with the ACCC, including a more automated process with greater upfront demands for data and evidence.

Our comprehensive review of the changes and what they mean is here in our article, It’s here! Everything you need to know about the merger reform legislation.

For the ACCC, market inquiries and consumer protection issues led the enforcement agenda

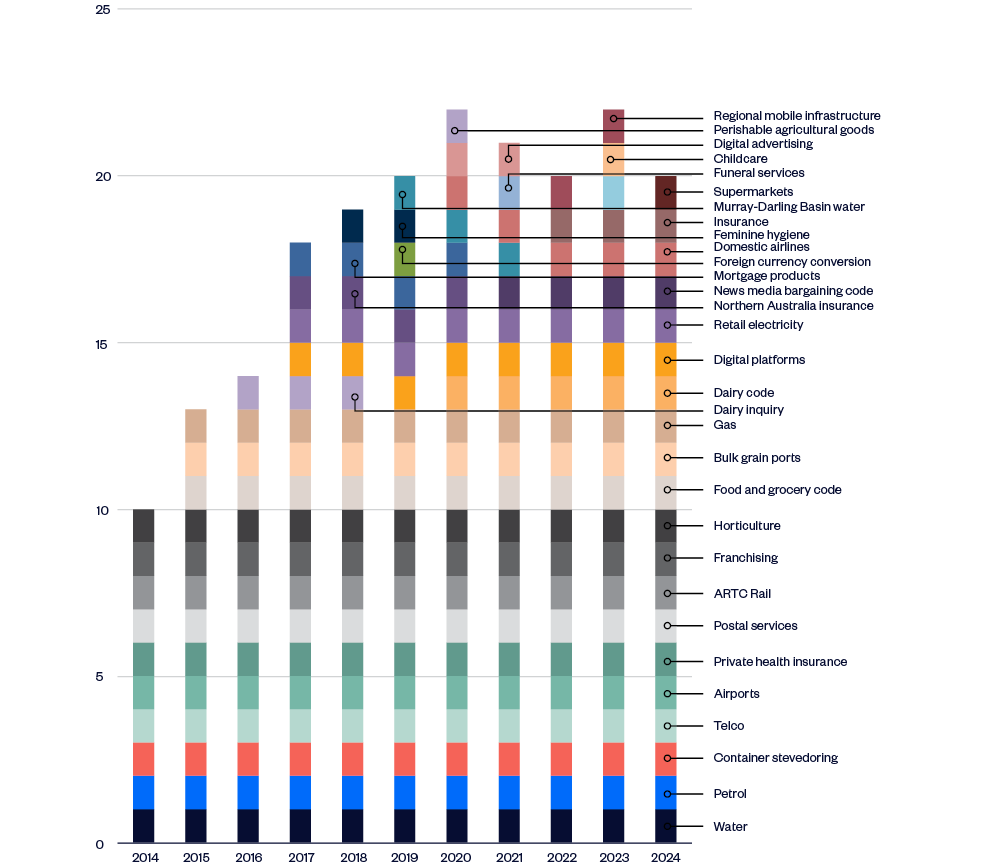

The ACCC seemed to be everywhere during 2024. This was reflected, on the ground, where our analysis tells the story of a convergence between competition law, consumer protection and industry policy, reflecting the broad mandate of the ACCC - made even broader by inquiries directed by the Treasurer.

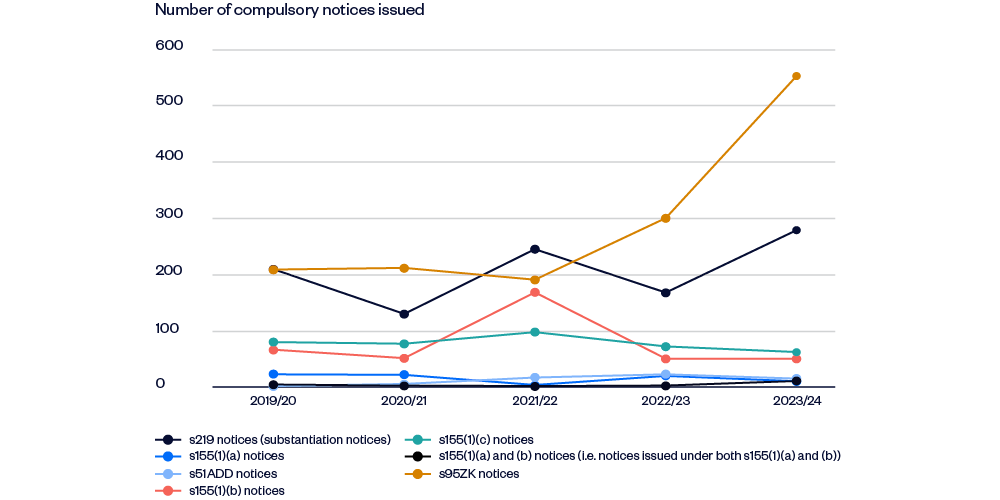

The ACCC was tasked with the high profile referrals from Canberra, including reviews of supermarkets and airport landing slots. It also investigated other high profile issues, with a public enforcement focus on consumer issues arising from the NDIS, energy pricing, digital platforms, and sustainability, amongst others. This emphasis is reflected in the data, where the number of ACCC notices issued in market inquiries under s95ZK has skyrocketed over the last two years and is now almost double the number of compulsory notices issued requesting documents and/or information under the standard investigation powers in s155.

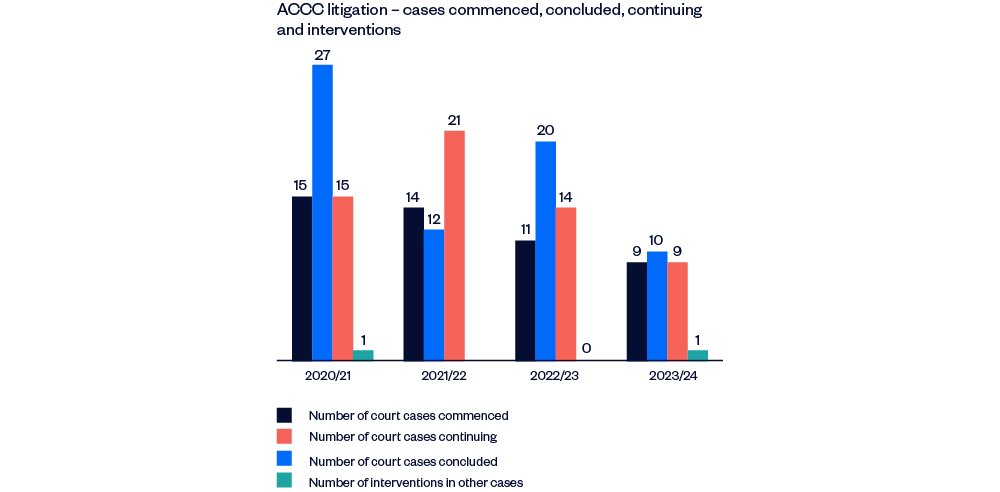

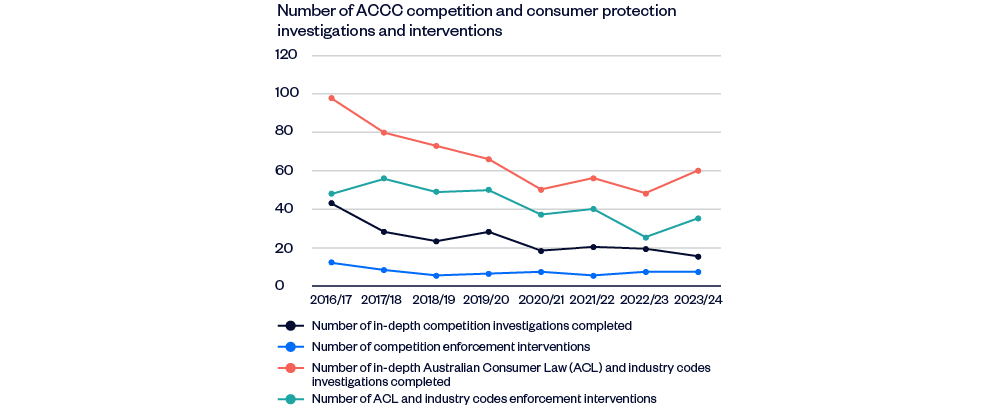

While there was a deep focus on consumer protection and wider market inquiries, the level of new competition enforcement proceedings was more limited, with a single price fixing prosecution commenced during the year.

Overall, direct ACCC enforcement of all kinds continued its downward trend in 2024.

While ACCC competition enforcement trended downward, 2024 was the year of s46 private enforcement and class actions

This year featured the first contested liability case to come before the Courts under the remodelled misuse of market power test, introduced in late 2017. Those were the aptly titled Epic cases, involving Epic’s claims against Apple and Google, coupled with follow-on class actions.

In addition to the hearing for the Epic cases held in March to July, there were other s46 cases that were commenced, heard, dismissed or discontinued during the year, including Stillwater v Stanwell (heard and judgment delivered), SA Country Pubs v AGL (withdrawn) and Q News and Sydney Times v Google (commenced).

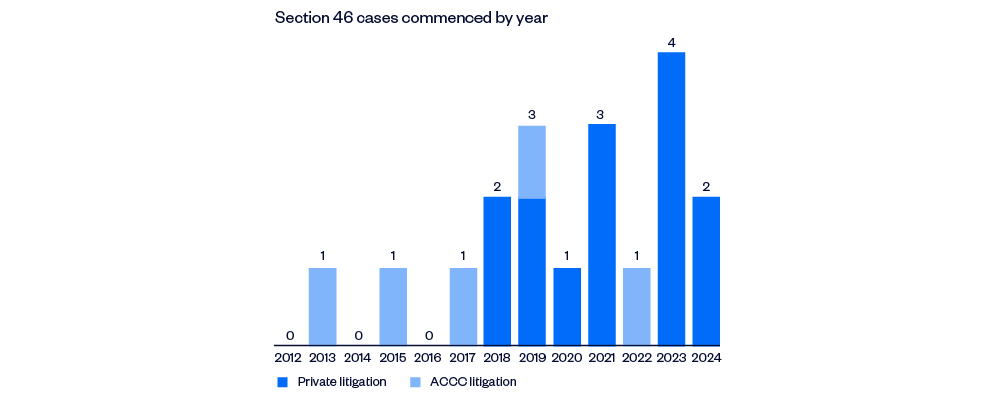

In the seven years since the new ‘effects test’ was introduced, there have been 16 cases commenced under the new s46, of which only two were brought by the ACCC. By comparison, in the five years prior to the changes (2012 - 2017), only three cases were commenced and all of them were initiated by the ACCC. The effects test is certainly alive and well.

Class actions have become a growing feature of the competition and consumer law landscape

Representative proceedings (ie class actions) also played a growing and important role in the competition and consumer law landscape in 2024. Examples included actions against:

Coles and Woolworths in relation to price claims (with two further representative proceedings filed in February 2025);

Jetstar in relation to cancelled flights during COVID;

Johnson & Johnson in relation to the marketing of branded cold and flu medicines;

Sony alleging misuse of market power in relation to access to the PlayStation platform;

AGL in South Australia and, separately, Stanwell in Queensland, in relation to bidding behaviour in the National Electricity Market (although the AGL case commenced in December 2023 and was withdrawn during 2024);

Google alleging misuse of market power and other competition grounds in relation to conduct associated with adtech services.

The risk of private litigation (including follow-on litigation such as Engage Marine v TasPorts) and the growing threat of class actions mean that litigation risk in relation to competition and consumer matters is more complex and challenging to navigate than ever.

In consumer law, the ACCC had a busy year taking on high profile targets

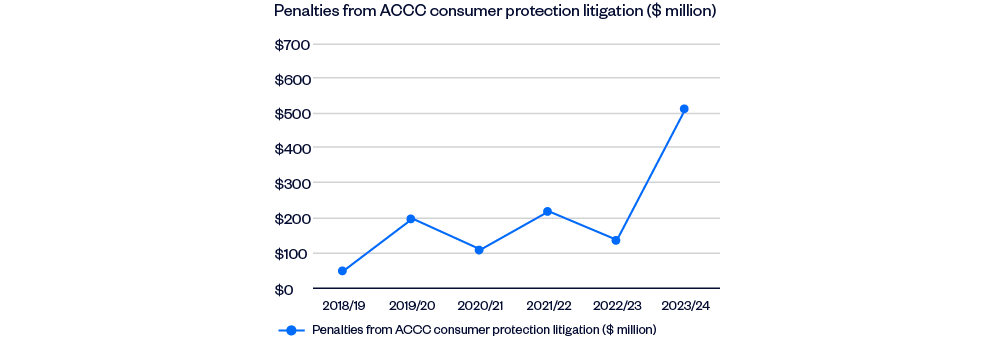

The ACCC commenced 11 new consumer law cases during 2024, almost one each month. Consistent with a focus on “cost of living” issues for consumers, many of these involved allegations of misleading pricing conduct by high profile respondents.

The year also included the largest consumer law penalty to date, when Qantas agreed to a $100 million penalty (with an additional $20 million in compensation) to settle the ACCC’s prosecution of Qantas’ approach to selling tickets for flights during and post COVID.

Both the ACCC and ASIC kept a litigation focus on environmental and sustainability claims

After having kept a focus on environmental and sustainability issues over the last couple of years, the ACCC brought proceedings against Clorox Australia for allegedly making misleading claims about “ocean plastic”. This will come to trial in early 2025. The ACCC also published important guidance for business around sustainability claims and consumer law in late 2023, and guidance around sustainability collaborations and competition law in late 2024.

Interestingly, ASIC had an even more vigorous enforcement role in relation to environmental claims during 2024, with three successful greenwashing prosecutions, against Active Super, Mercer and Vanguard. These cases all focused on claims made about the ethical or sustainable nature of investment products. As well as cases brought by the regulator, it was also a year when a number of public interest bodies took on energy suppliers around Net Zero and carbon claims (in Australasian Centre for Corporate Responsibility v Santos and Australian Parents for Climate Action v EnergyAustralia). These are in addition to Greenpeace v Woodside, which commenced in December 2023.

Looking forward, a major consumer law challenge in 2025 may be grappling with a proposal for a broad prohibition on “unfair” conduct

The ACCC has long argued for a broad prohibition to be introduced in relation to unfair conduct, which it suggests is needed to fill the gaps that otherwise may exist between other types of consumer protection (such as misleading conduct and unconscionability).

While many, including G+T, question whether such gaps exist and whether a new and broad power is really necessary or warranted – the coming year may nonetheless be the year that it arrives. In November, Treasury released a consultation paper with options for mandating a general prohibition on unfair conduct, either with or without specific targeted forms of conduct.

Based on the Treasury paper, the new prohibition looks likely to target conduct which “unreasonably distorts or manipulates” decision making by consumers and which is likely to cause material detriment to them.

While this will extend across the economy, the unfairness regime is squarely aimed at online marketing practices, such as subscription traps, dark patterns and some drip or dynamic pricing practices. If this proposal becomes law, we expect those markets to be the focus of early ACCC test cases.

The other big focus in 2025 will be on an emerging regulatory framework for the large digital platforms

The last big trend to watch in 2025 will be regulation of digital platforms. The ACCC first flagged a desire for some kind of upfront regulatory regime in 2022, as part of its rolling Digital Platform Services Inquiry. However, to some extent, Australia has been biding its time waiting for the dust to settle from the introduction of new digital regulation in the EU, UK, Japan, India and elsewhere.

With those regimes now in place, there is pressure to act. In December 2024, Treasury released a paper setting out options for a new digital competition regime. The proposed regime looks likely to be modelled on the overseas experience, with a combination of general and specific prohibitions. The rules would be imposed on large, global players with significant Australian revenues and following designation by the Minister (on a recommendation by the ACCC). In the first instance, it is proposed that app market place services and ad tech services would be the first services to be investigated for designation.

It’s clear that there is a strong desire to ensure that Australia is aligned with steps taken elsewhere and that it gets the benefit of regulatory solutions that are agreed between the global digital platforms and regulators in Europe or the UK. Treasury has therefore proposed that a designated platform can be deemed to comply with Australian regulation if it offers up an acceptable solution that has been adopted elsewhere.

There is much more detail to be developed, including the nature of the service specific rules, penalties and review options. But the goal is for Australia to be a “fast follower” in this area so the direction of travel is pretty clear.

Bringing it together: what does it all mean for 2025?

Both globally and locally, we are facing a period of fast-moving and disruptive change. Over recent years, we have witnessed the political and economic “vibe” in Europe and the United States influence antitrust priorities and regulatory approaches in Australia. It remains to be seen whether the disruptive influence of the Trump administration leads to a similar shift in sentiment over 2025 and beyond.

At the very least, we face a year of more change. New merger laws. New digital platform regulation. Potentially significant expansion of consumer law. This is all occurring against the backdrop of the ACCC continuing to play a wide, market-monitoring role across swathes of the economy and with a more complex enforcement environment featuring growth in private enforcement under s46, activist litigation and class actions.

Get a good lawyer and hold on to your seat.