From 1 January 2026, Australia will have a new merger regime requiring notification of transactions which meet notification thresholds. Yesterday, the ACCC published guidance on transitional arrangements to this new regime, providing guidance to parties planning deals in the second half of 2025 as the new regime begins to take effect.

In the ACCC’s media release, Chair Gina Cass-Gottlieb stated: “A key message is that if businesses are considering seeking an informal merger review after 1 July 2025, it is important they engage with us as soon as possible… This will help manage the risk that there won’t be enough time for the ACCC to complete its assessment before the new mandatory merger review process comes into effect”.

The ACCC cautioned that it will consider all available enforcement options for anti-competitive acquisitions completed or proposed to complete before or after 1 January 2026 without approval. This includes seeking urgent injunctions to prevent completion and taking post-completion action.

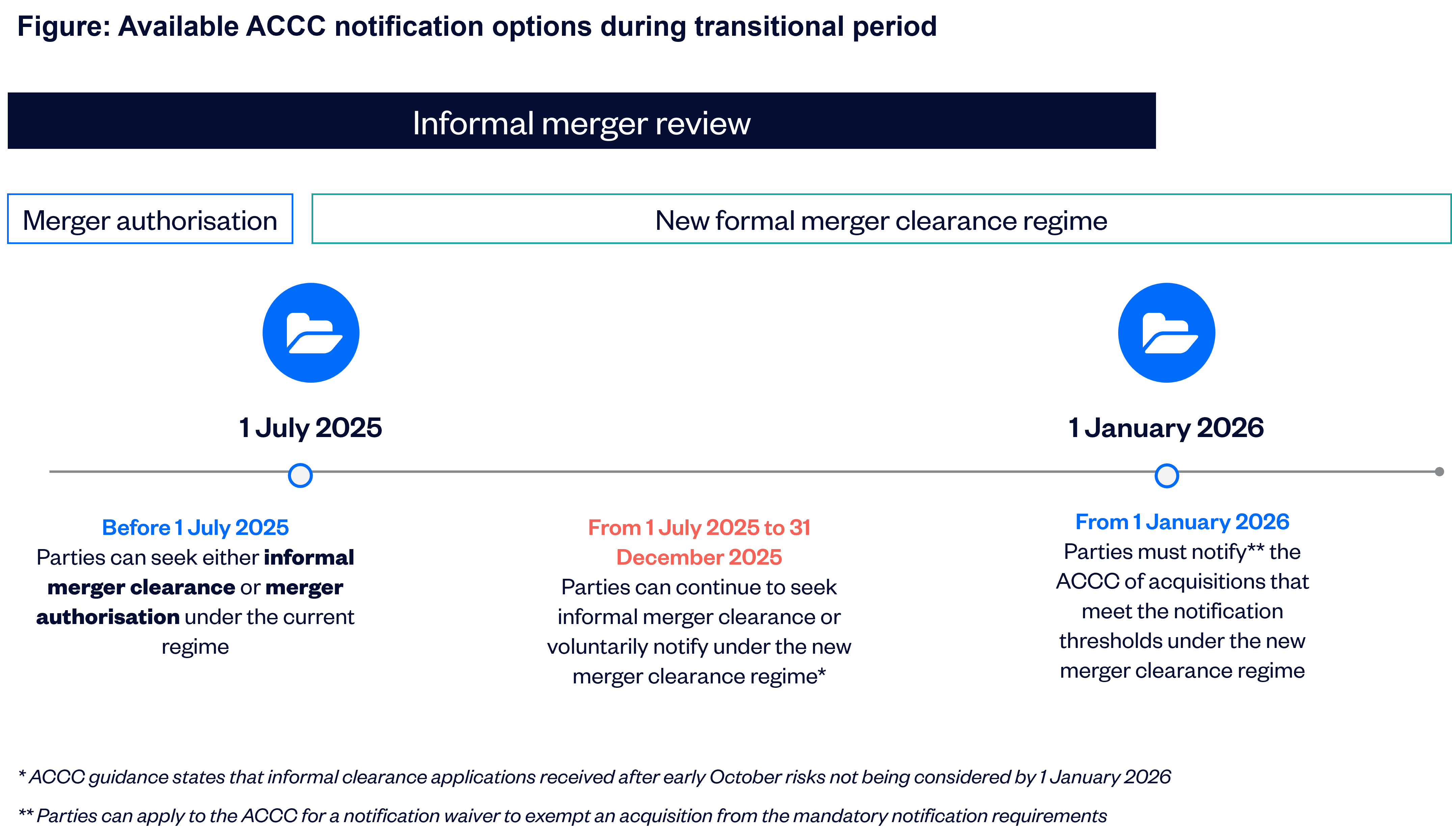

This article provides a guide to the available options and considerations for engaging with the ACCC during the following periods:

Before 1 July 2025 (before voluntary notification under the new regime becomes available)

From 1 July 2025 to 31 December 2025 (when parties can voluntarily notify under the new regime)

From 1 January 2026 (when it becomes mandatory for acquisitions that meet the notification thresholds to notify and obtain ACCC clearance under the new regime).

Between now and 1 July 2025

Until 1 July 2025, parties can seek clearance under the existing informal merger review or merger authorisation processes.

Merger parties should carefully consider the likely completion timetable for any potential acquisitions started in this window. If parties are not likely to receive ACCC clearance or authorisation under the existing regime, and/or the proposed acquisition will not be completed before 1 January 2026, they may need to seek an updated informal view from the ACCC in second half of the 2025 calendar year. Additionally they may need to re-notify under the new merger clearance regime to ensure compliance with the mandatory notification requirements effective from 1 January 2026.

If there is a likelihood of not receiving clearance or authorisation in sufficient time, parties will need to consider whether to hold off and file under the new transitional regime, which commences on 1 July 2025.

ACCC notification option | Timing considerations | |

Option 1: Apply for informal merger clearance |

| |

Option 2: Apply for merger authorisation

|

|

Seeking an updated informal view from the ACCC

As discussed above, where parties have obtained informal clearance but cannot complete the transaction prior to 1 January 2026 (for clearances obtained prior to 1 July 2025) or within 12 months of obtaining clearance (for clearances obtained after 1 July 2025), they may seek an updated informal view from the ACCC from 1 July 2025 onwards. This effectively provides an extension for the parties to complete the transaction.

Where parties need to obtain an updated informal view, the ACCC encourages parties to request this as early as possible and by early October 2025, noting that requests made after this time are “much less likely to be completed before 1 January 2026”.

If the ACCC maintains its original review, it will provide the parties with an updated clearance letter, meaning the parties will not need to notify the acquisition under the new regime as long as the acquisition is completed within 12 months of this new letter’s date.

When requesting an updated informal view, the ACCC encourages parties to provide updates on any changes, such as changes in the relevant markets or updated market share information. Possible outcomes include:

Where there hasn’t been a material change, the ACCC’s usual approach will be to issue a new clearance letter.

Where there have been material changes in the markets or the ACCC otherwise considers it needs to seek further clarity, it may commence a follow-up public review or pre-assessment review (with or without targeted inquiries). It may be possible to have a shortened review timeline, given the ACCC’s familiarity with the acquisition.

If the ACCC is unable to complete an updated informal review, and the acquisition meets the new notification thresholds, merger parties will need to notify under the new regime or apply for a notification waiver. This means the parties will be exempt from the notification requirements – the ACCC has indicated it will provide more information in relation to its notification waiver powers “later in 2025”.

Between 1 July 2025 to 31 December 2025

From 1 July 2025, merger parties can no longer apply for merger authorisation. Merger parties can continue to use the current informal merger review process or choose to voluntarily notify under the new merger regime.

Merger parties must consider the timing implications for continuing to use the informal merger review process (especially between October and December 2025). Especially if there is a risk the ACCC cannot finalise its review by 31 December 2025 and/or the parties are unable to complete the acquisition within 12 months of obtaining the ACCC informal clearance decision.

The risk that the ACCC will not be able to finalise an informal review is particularly high after October.

ACCC notification option | Timing considerations | |

Option 1: Apply for informal merger clearance |

| |

Option 2: Voluntarily notify under the new merger clearance regime | This option provides parties greater certainty because it ensures it will not be necessary to re-notify if the acquisition meets the new mandatory notification thresholds from 1 January 2026, even if the ACCC’s consideration extends beyond this date. This becomes a particularly important option to consider after October 2025, as the ACCC has flagged there is significant risk that its informal clearance processes will not provide a view before 1 January 2026 for transactions notified after this time. As we reported here, under the new merger clearance regime:

|

From 1 January 2026

From 1 January 2026, parties must notify acquisitions that meet the new notification thresholds under the new clearance regime and the informal merger review process will no longer be available. For notifiable acquisitions, parties may apply for a notification waiver to exempt them from the mandatory notification obligation.

For acquisitions that do not meet the new notification thresholds, the ACCC will continue to have the power to take enforcement action where it considers it will have the effect or likely effect of substantially lessening competition (that is, under s 50 of the Competition and Consumer Act, which will remain in force). The ACCC encourages parties to notify acquisitions that may raise material competition issues, including where there is uncertainty about whether the thresholds are met, to manage any potential risk of legal action under s 50.

What further details are we waiting for?

We are still waiting on several key details on the practical workings of the new merger regime:

While the Government has released its proposed notification thresholds, the final thresholds are yet to be set by a Treasury Minister in a legislative instrument in Q1 2025.

The ACCC will provide more information about the waiver process “later in 2025”.

The ACCC will consult on draft process guidelines, draft analytical guidelines and notification forms in Q1 2025.